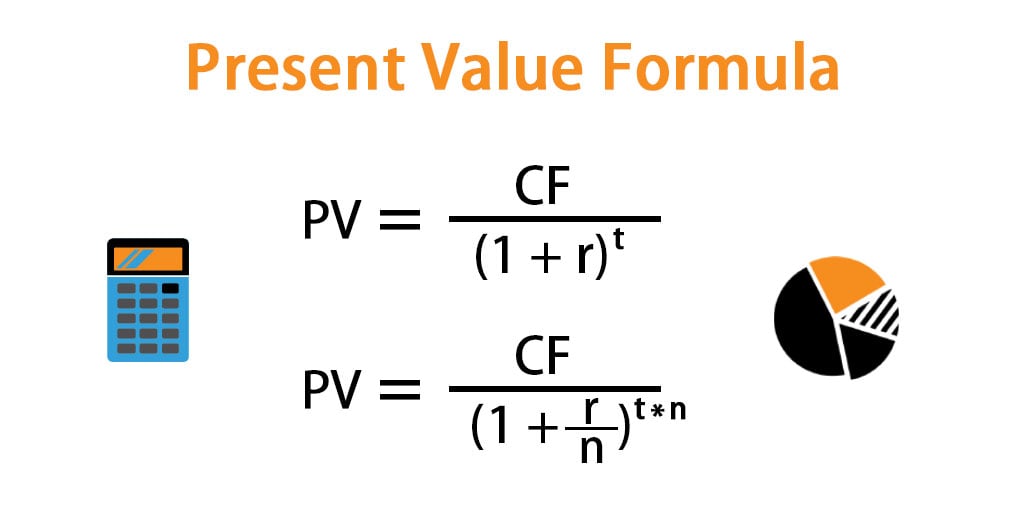

Calculate Present Value Of Cash Flows - Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. The formula for calculating present value (pv) is pv = cf / (1 + r)^n. In this formula, “cf” is the future cash flow, “r” is the periodic.

The formula for calculating present value (pv) is pv = cf / (1 + r)^n. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash. In this formula, “cf” is the future cash flow, “r” is the periodic.

Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash. In this formula, “cf” is the future cash flow, “r” is the periodic. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. The formula for calculating present value (pv) is pv = cf / (1 + r)^n.

How To Calculate Net Present Value of Cash Flows in Irregular Periods

Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash. The formula for calculating present value (pv) is pv = cf / (1 + r)^n. In this formula, “cf” is the future cash flow, “r” is the periodic. The formula used to calculate the present value (pv) divides the future.

Present Value of Cash Flows Calculator

The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. The formula for calculating present value (pv) is pv = cf / (1 + r)^n. In this formula, “cf” is the future cash flow, “r” is the periodic. Pv is used to evaluate and compare different.

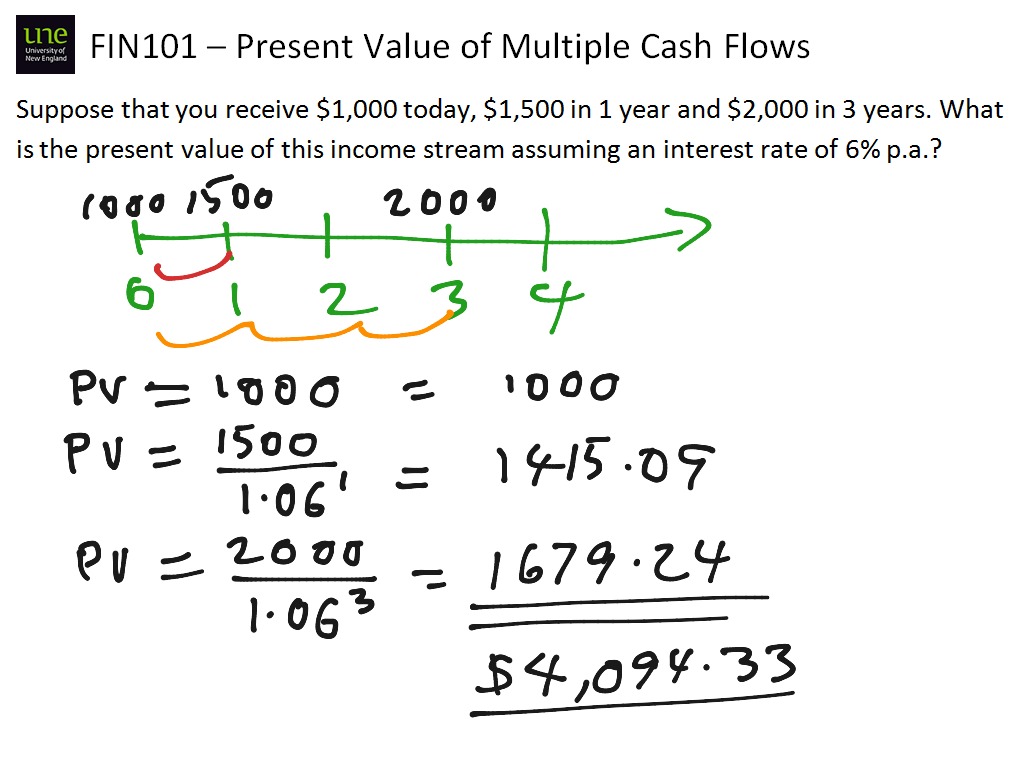

Present Value of Multiple Cash Flows Time Value Of Money ShowMe

In this formula, “cf” is the future cash flow, “r” is the periodic. Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. The formula for.

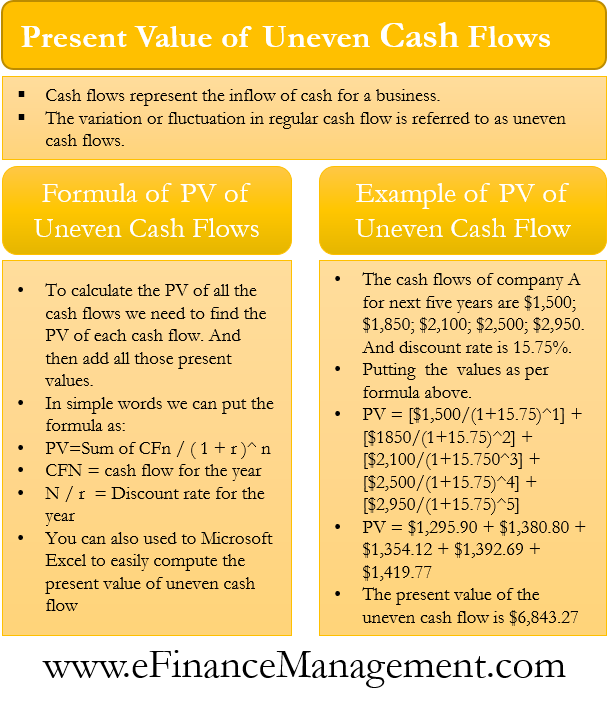

How to Calculate Present Value of Uneven Cash Flows in Excel

Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. In this formula, “cf” is the future cash flow, “r” is the periodic. The formula for.

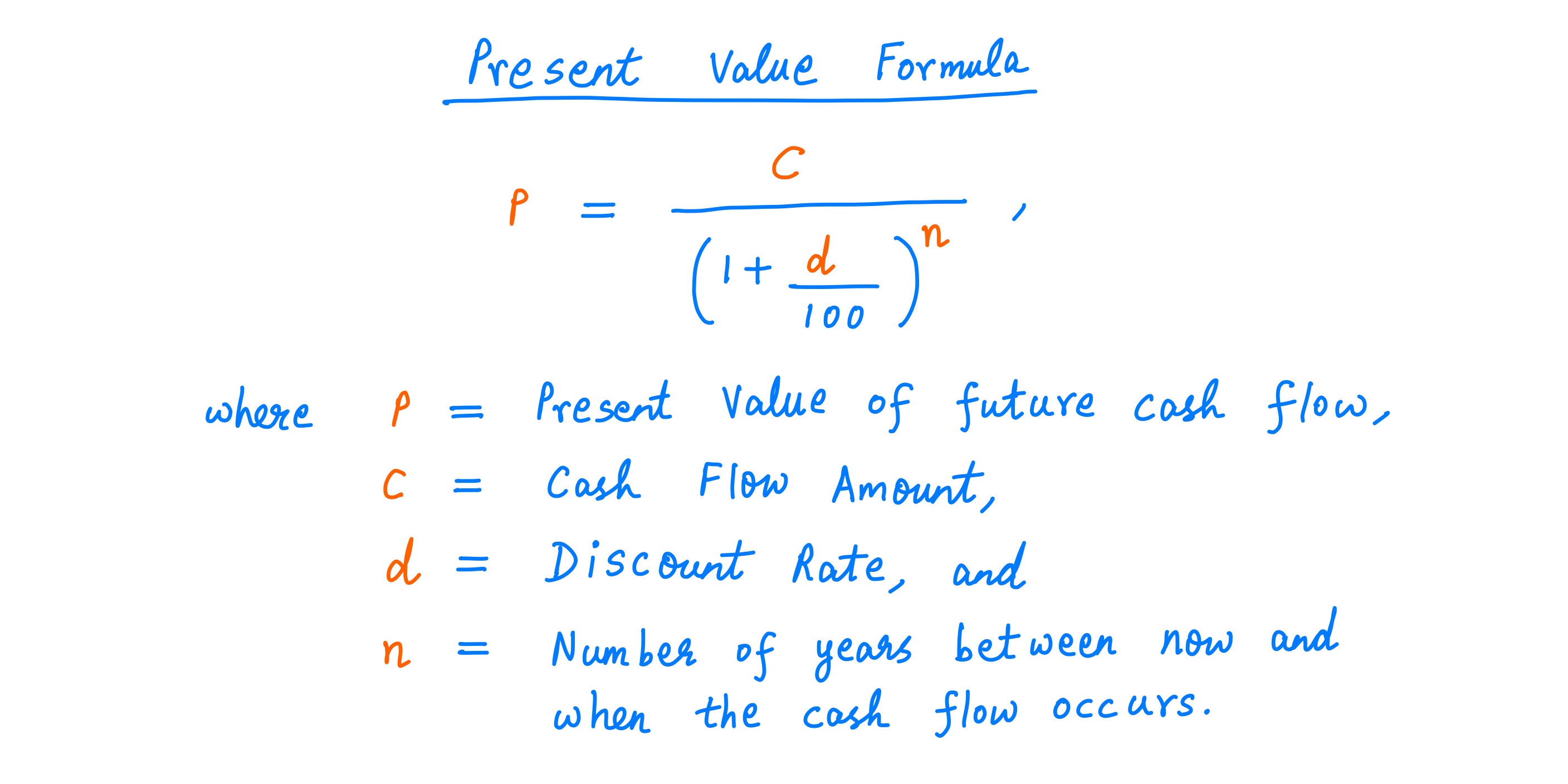

Present Value Formula

The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. The formula for calculating present value (pv) is pv = cf / (1 + r)^n. Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash. In.

Present Value of Cash Flows Calculator Finance Calculator iCalcula

The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. The formula for calculating present value (pv) is pv = cf / (1 + r)^n. In this formula, “cf” is the future cash flow, “r” is the periodic. Pv is used to evaluate and compare different.

Present Value Excel Template

Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash. In this formula, “cf” is the future cash flow, “r” is the periodic. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. The formula for.

Present value of uneven cash flows ba ii plus FINED YouTube

In this formula, “cf” is the future cash flow, “r” is the periodic. The formula for calculating present value (pv) is pv = cf / (1 + r)^n. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. Pv is used to evaluate and compare different.

Cash flow stream calculator JacareAlisa

In this formula, “cf” is the future cash flow, “r” is the periodic. The formula for calculating present value (pv) is pv = cf / (1 + r)^n. Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash. The formula used to calculate the present value (pv) divides the future.

Continuous Money Flow Total and Present Value Wilson Whamess

Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash. The formula for calculating present value (pv) is pv = cf / (1 + r)^n. In this formula, “cf” is the future cash flow, “r” is the periodic. The formula used to calculate the present value (pv) divides the future.

In This Formula, “Cf” Is The Future Cash Flow, “R” Is The Periodic.

The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. The formula for calculating present value (pv) is pv = cf / (1 + r)^n. Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash.