Calculating Free Cash Flow From Ebitda - Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free. You could also calculate free cash flow by starting with net income:

You could also calculate free cash flow by starting with net income: Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free.

Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free. You could also calculate free cash flow by starting with net income:

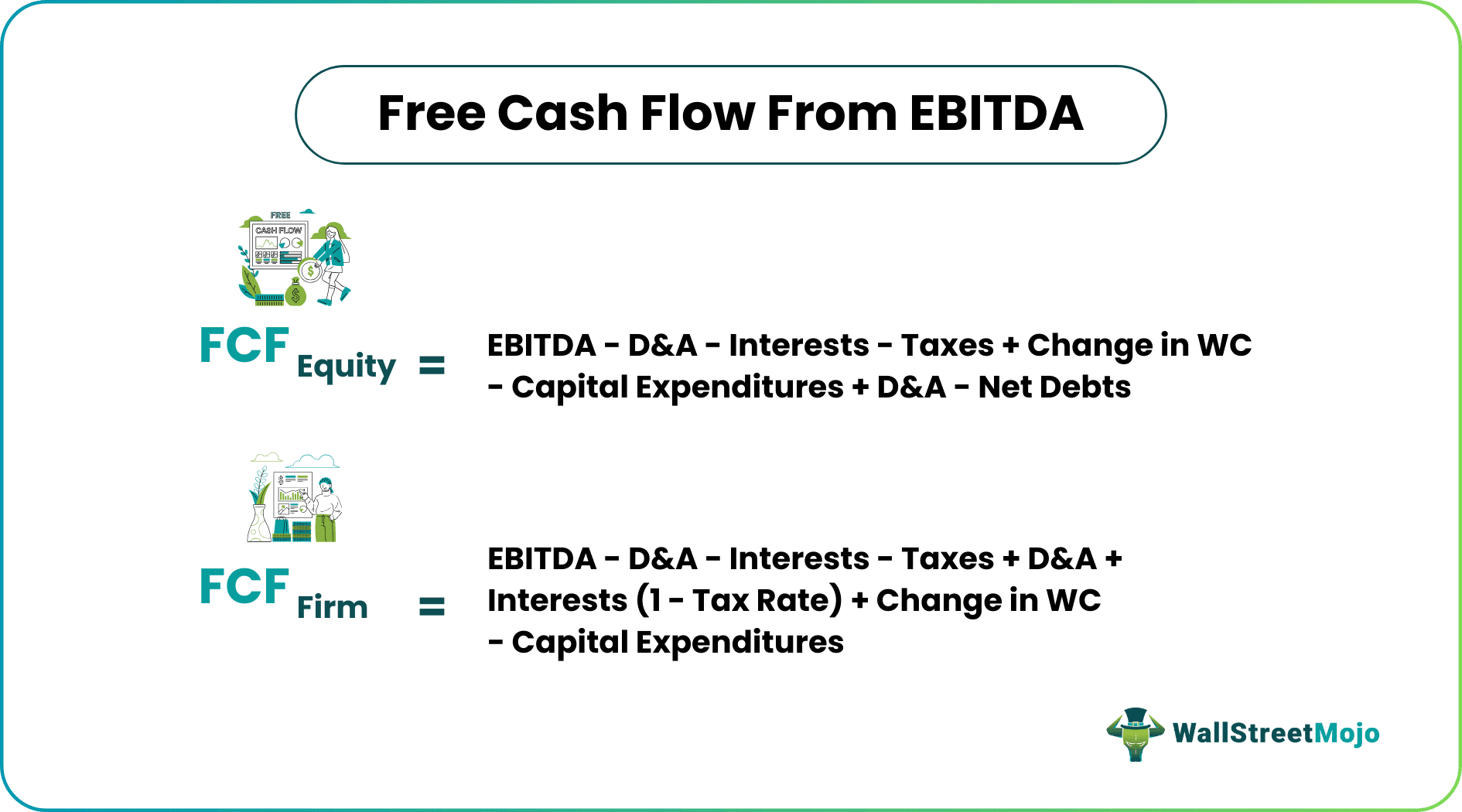

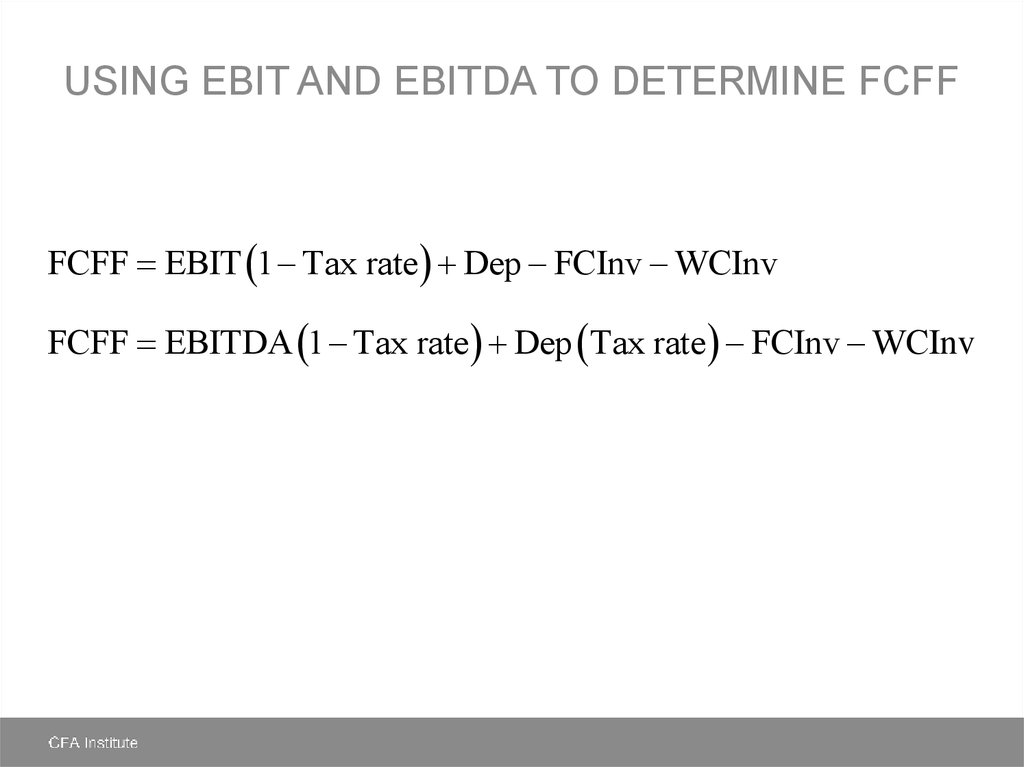

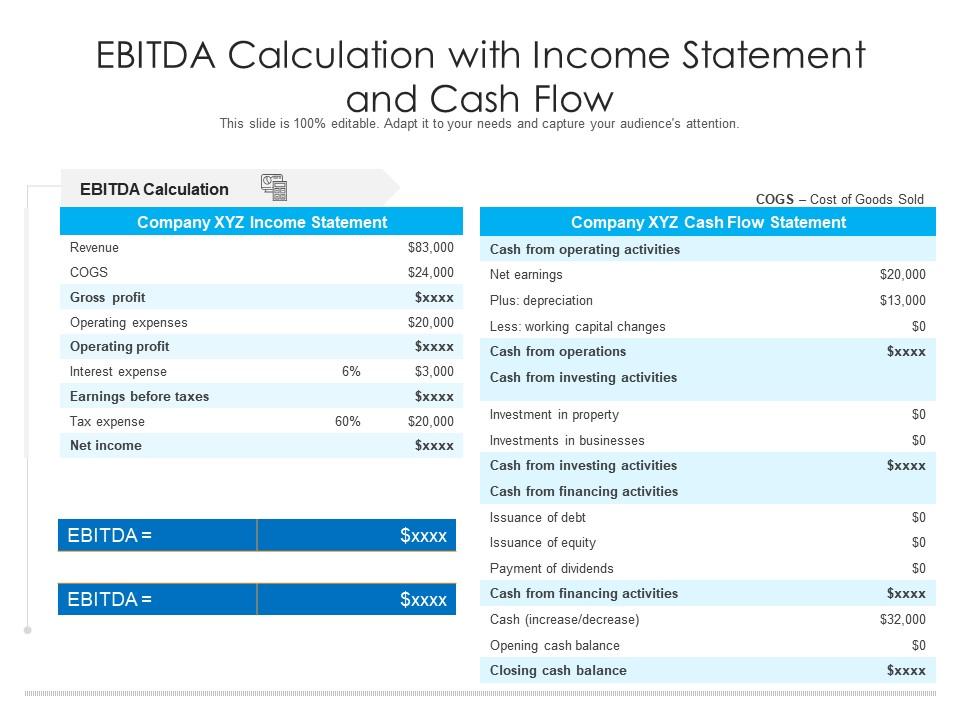

Free Cash Flow from EBITDA How to Calculate?

Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free. You could also calculate free cash flow by starting with net income:

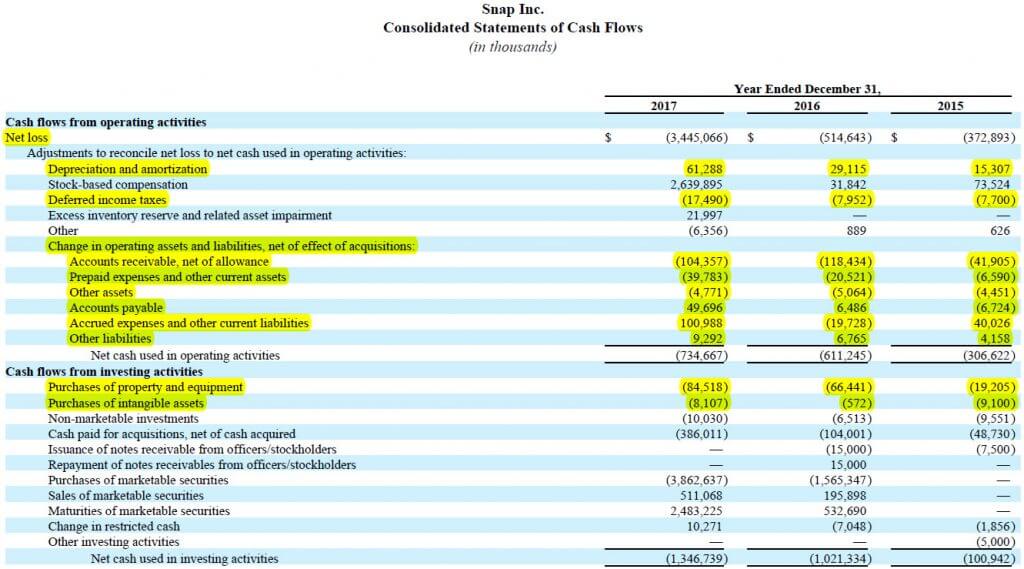

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf

Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free. You could also calculate free cash flow by starting with net income:

Free Cash Flow (FCF) Formula, Analysis, Examples Capital City

You could also calculate free cash flow by starting with net income: Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free.

How to Calculate FCFE from EBITDA Overview, Formula, Example

Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free. You could also calculate free cash flow by starting with net income:

The Ultimate Cash Flow Guide (EBITDA, CF, FCF, FCFE, FCFF)

You could also calculate free cash flow by starting with net income: Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free.

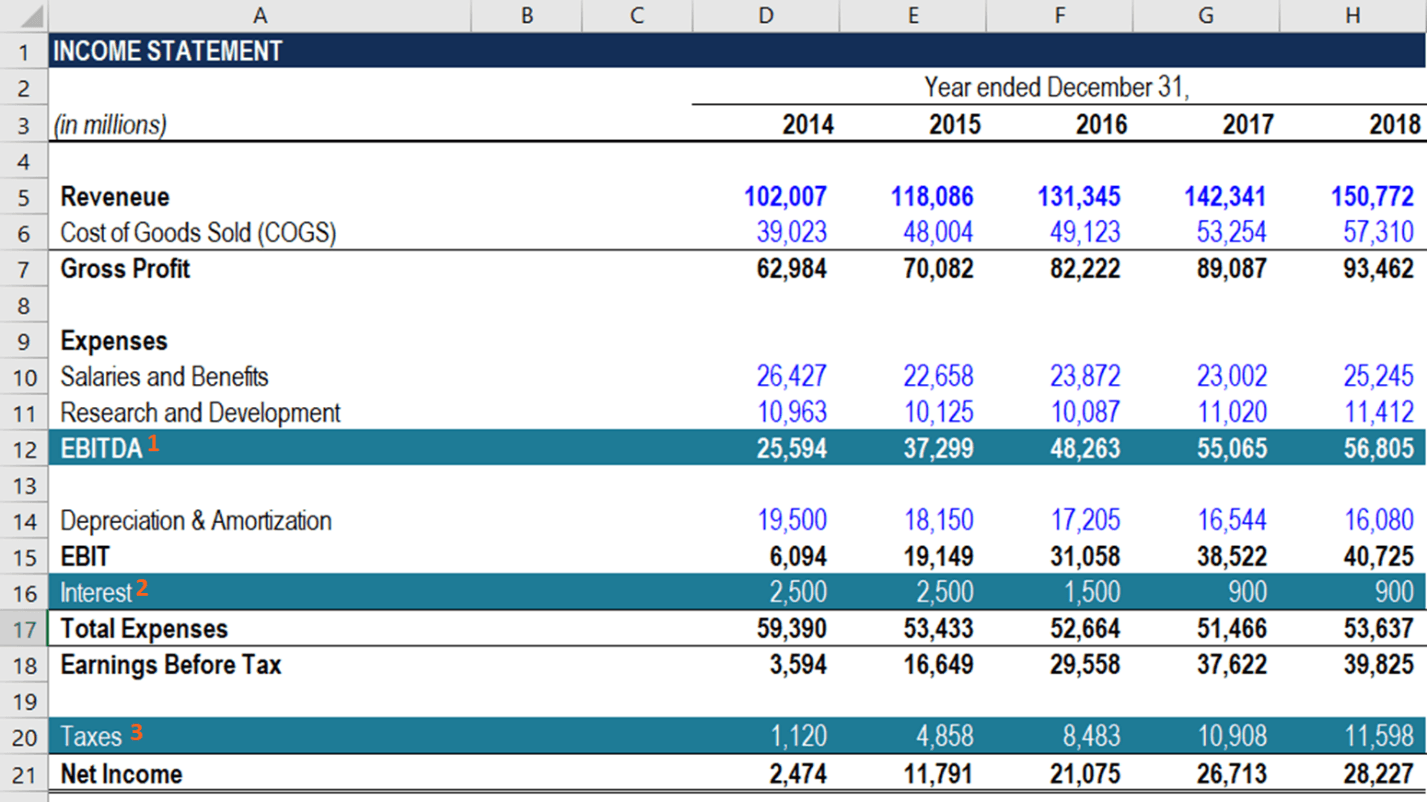

EBITDA to FCF Full Tutorial, Examples, and Excel Files

Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free. You could also calculate free cash flow by starting with net income:

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf

You could also calculate free cash flow by starting with net income: Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free.

Cash flow from ebitda instadun

Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free. You could also calculate free cash flow by starting with net income:

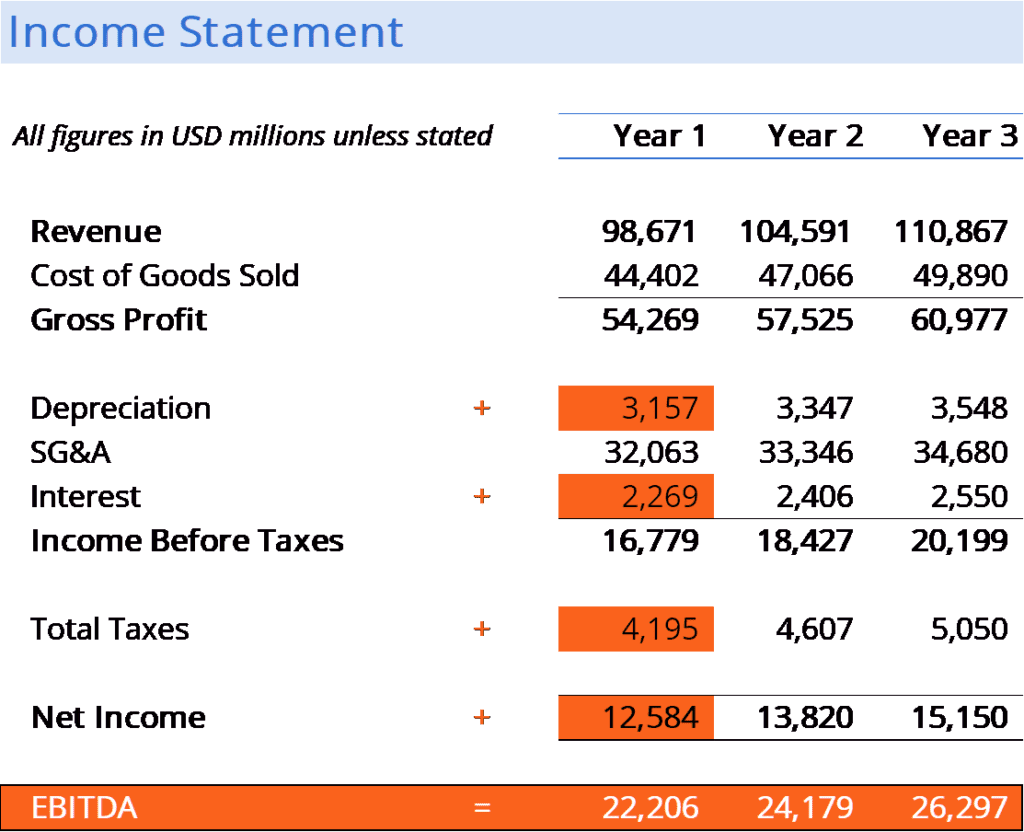

What is EBITDA Formula, Definition and Explanation

Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free. You could also calculate free cash flow by starting with net income:

You Could Also Calculate Free Cash Flow By Starting With Net Income:

Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free.