E Invoicing Malaysia Guidelines Pdf - New businesses or operations commencing from year 2023 to 2025 with annual turnover or revenue of at least rm500,000 are required to. Donations or contributions released by the inland revenue board of malaysia (irbm) on 7 july 2025. However, certain buyers, particularly end con.

New businesses or operations commencing from year 2023 to 2025 with annual turnover or revenue of at least rm500,000 are required to. However, certain buyers, particularly end con. Donations or contributions released by the inland revenue board of malaysia (irbm) on 7 july 2025.

Donations or contributions released by the inland revenue board of malaysia (irbm) on 7 july 2025. New businesses or operations commencing from year 2023 to 2025 with annual turnover or revenue of at least rm500,000 are required to. However, certain buyers, particularly end con.

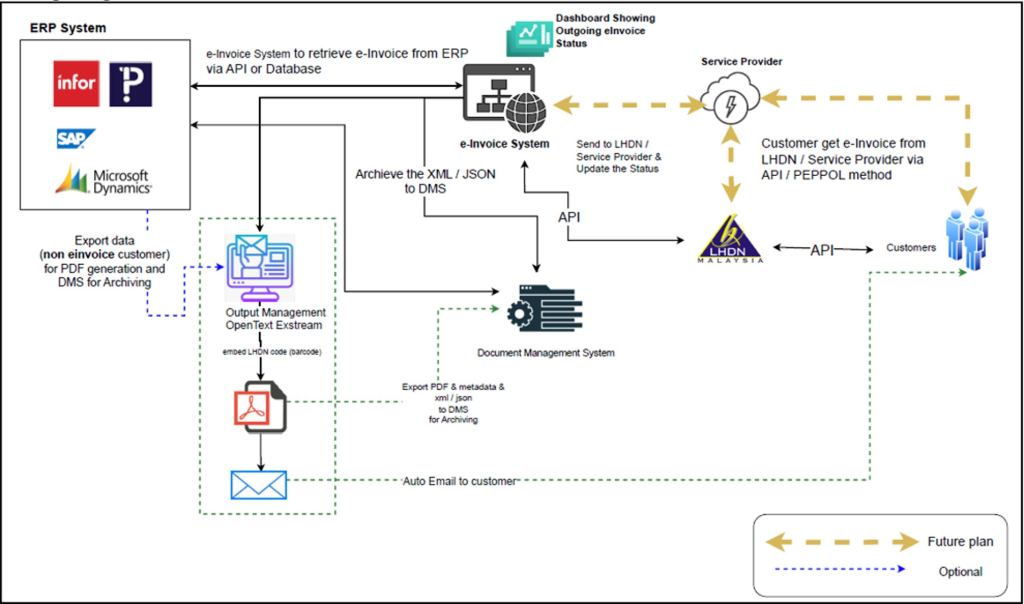

Sample of Malaysian einvoicing CCS

Donations or contributions released by the inland revenue board of malaysia (irbm) on 7 july 2025. New businesses or operations commencing from year 2023 to 2025 with annual turnover or revenue of at least rm500,000 are required to. However, certain buyers, particularly end con.

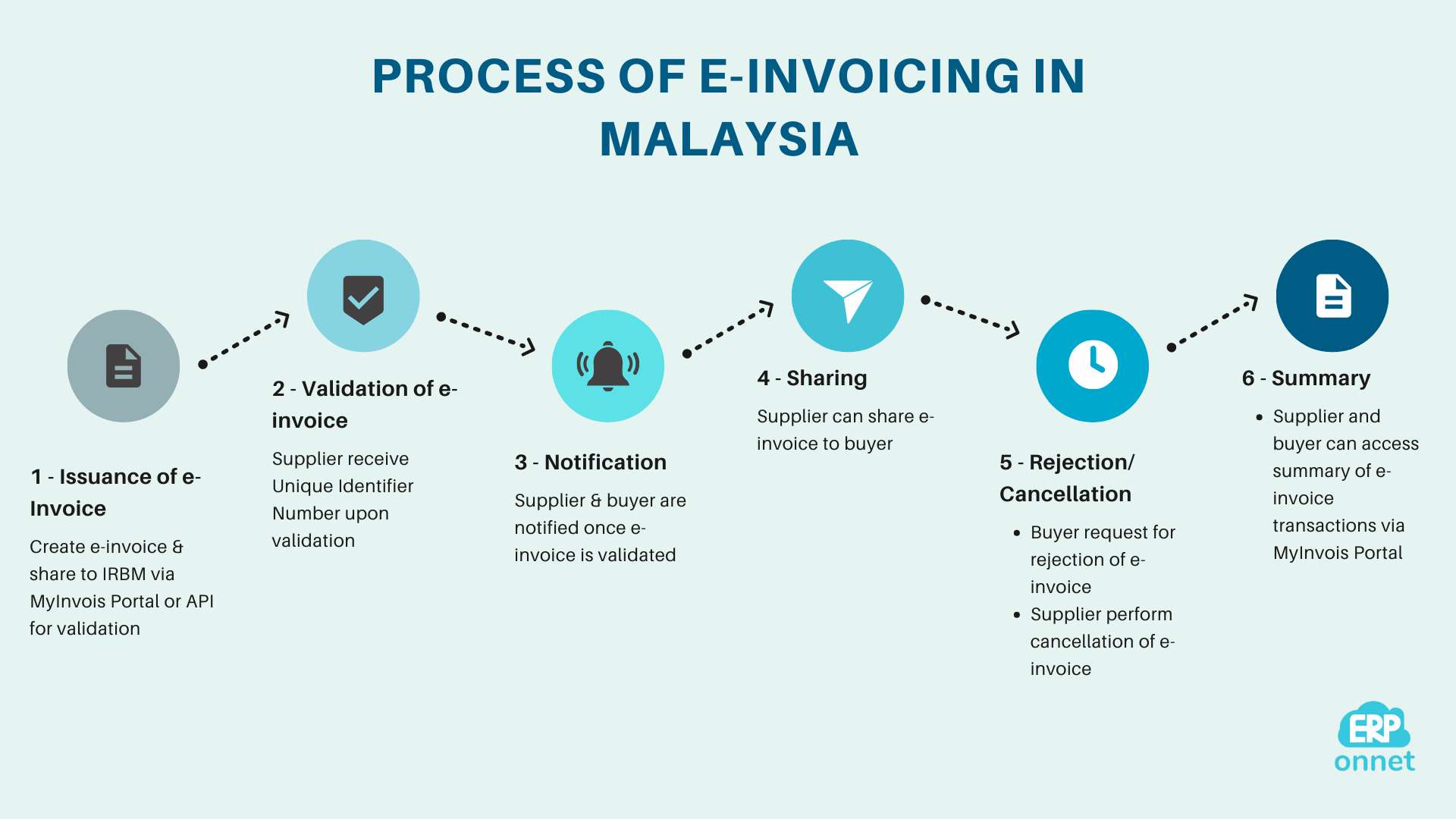

Malaysia LHDN eInvoice Guidelines 50 QnA L & Co Accountants

Donations or contributions released by the inland revenue board of malaysia (irbm) on 7 july 2025. However, certain buyers, particularly end con. New businesses or operations commencing from year 2023 to 2025 with annual turnover or revenue of at least rm500,000 are required to.

Understanding EInvoicing Malaysia Guidelines Full Guide

However, certain buyers, particularly end con. New businesses or operations commencing from year 2023 to 2025 with annual turnover or revenue of at least rm500,000 are required to. Donations or contributions released by the inland revenue board of malaysia (irbm) on 7 july 2025.

ReadyMade MountainTop Malaysia eInvoice Solution for all ERPs

However, certain buyers, particularly end con. Donations or contributions released by the inland revenue board of malaysia (irbm) on 7 july 2025. New businesses or operations commencing from year 2023 to 2025 with annual turnover or revenue of at least rm500,000 are required to.

Malaysia LHDN eInvoice Guidelines 50 QnA L & Co Accountants

New businesses or operations commencing from year 2023 to 2025 with annual turnover or revenue of at least rm500,000 are required to. However, certain buyers, particularly end con. Donations or contributions released by the inland revenue board of malaysia (irbm) on 7 july 2025.

Malaysia E Invoicing 2024 Magda Roselle

New businesses or operations commencing from year 2023 to 2025 with annual turnover or revenue of at least rm500,000 are required to. However, certain buyers, particularly end con. Donations or contributions released by the inland revenue board of malaysia (irbm) on 7 july 2025.

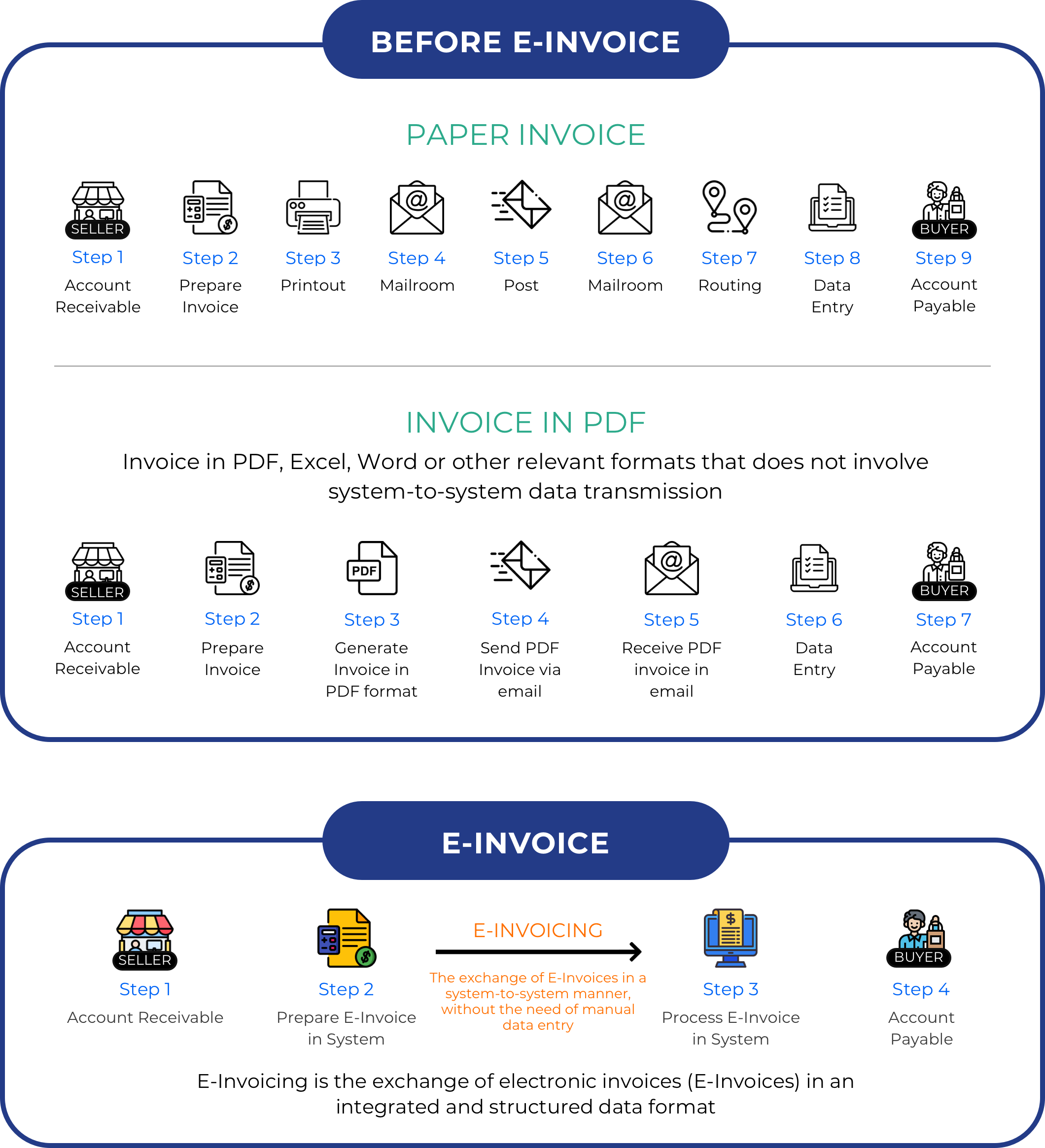

What is Einvoicing in Malaysia? IFCA MSC BHD

New businesses or operations commencing from year 2023 to 2025 with annual turnover or revenue of at least rm500,000 are required to. Donations or contributions released by the inland revenue board of malaysia (irbm) on 7 july 2025. However, certain buyers, particularly end con.

Understanding Malaysia's EInvoicing Landscape A Comprehensive Guide

Donations or contributions released by the inland revenue board of malaysia (irbm) on 7 july 2025. New businesses or operations commencing from year 2023 to 2025 with annual turnover or revenue of at least rm500,000 are required to. However, certain buyers, particularly end con.

National EInvoicing MDEC

However, certain buyers, particularly end con. Donations or contributions released by the inland revenue board of malaysia (irbm) on 7 july 2025. New businesses or operations commencing from year 2023 to 2025 with annual turnover or revenue of at least rm500,000 are required to.

Inland Revenue Board of Malaysia updated eInvoice (V2.1) and eInvoice

New businesses or operations commencing from year 2023 to 2025 with annual turnover or revenue of at least rm500,000 are required to. However, certain buyers, particularly end con. Donations or contributions released by the inland revenue board of malaysia (irbm) on 7 july 2025.

Donations Or Contributions Released By The Inland Revenue Board Of Malaysia (Irbm) On 7 July 2025.

New businesses or operations commencing from year 2023 to 2025 with annual turnover or revenue of at least rm500,000 are required to. However, certain buyers, particularly end con.