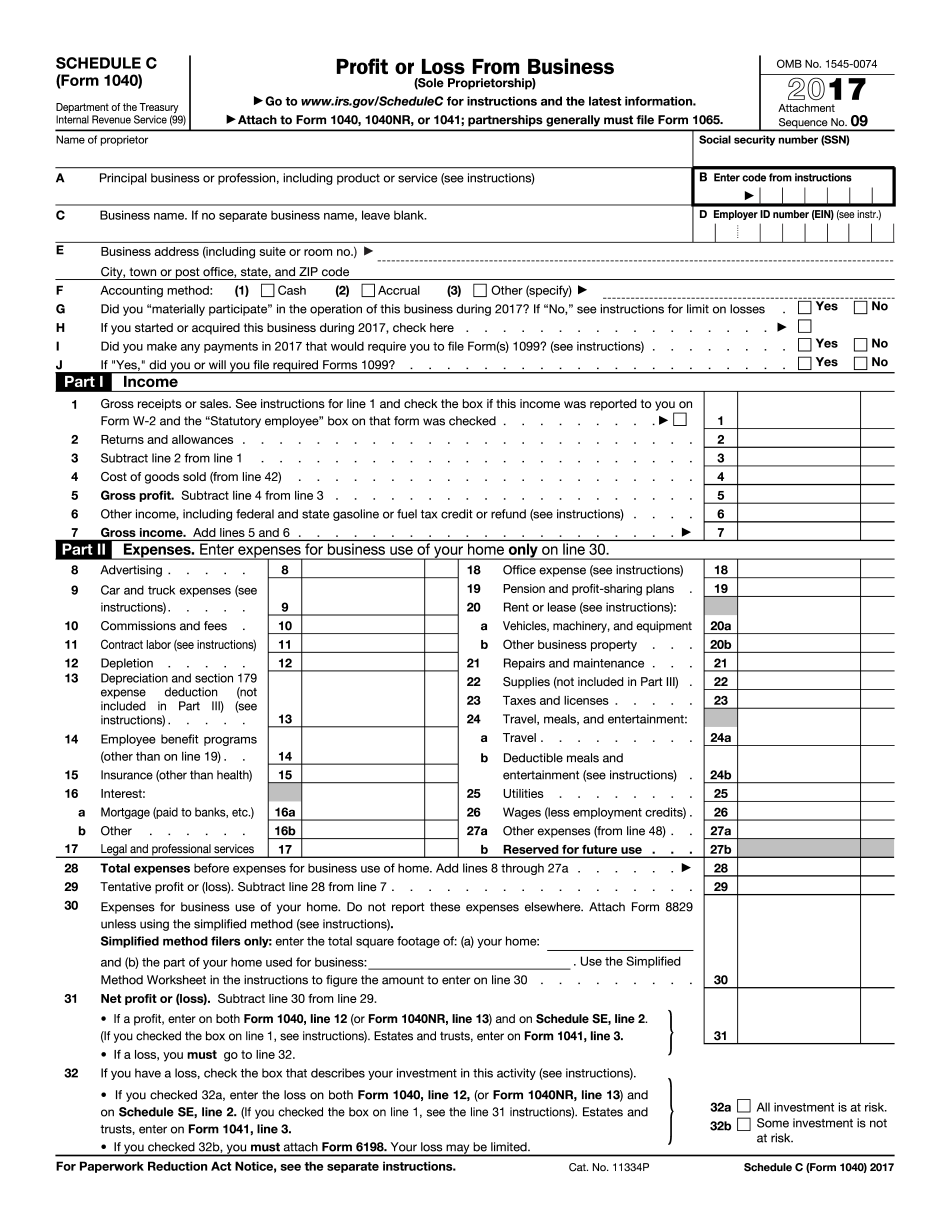

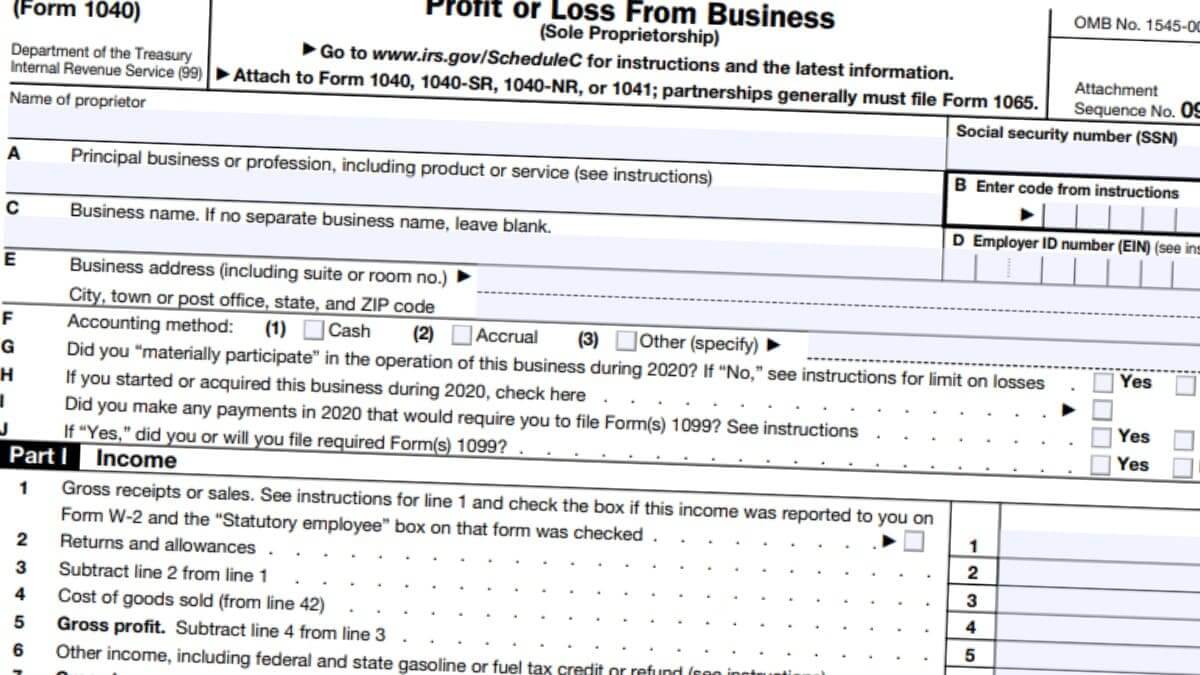

Fillable Schedule C Form 1040 2024 - The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Go to www.irs.gov/schedulec for instructions and the latest information. If no separate business name, leave blank. 51business income (schedule c) (cont.)

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Go to www.irs.gov/schedulec for instructions and the latest information. If no separate business name, leave blank. 51business income (schedule c) (cont.)

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. If no separate business name, leave blank. 51business income (schedule c) (cont.) Go to www.irs.gov/schedulec for instructions and the latest information.

Schedule C Tax Form 2024 Libbi Roseanne

Go to www.irs.gov/schedulec for instructions and the latest information. 51business income (schedule c) (cont.) The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. If no separate business name, leave blank.

Irs Fillable Forms 2024 Schedule C Penny Blondell

Go to www.irs.gov/schedulec for instructions and the latest information. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. If no separate business name, leave blank. 51business income (schedule c) (cont.)

2024 Irs Schedule C 2024 Calendar Template Excel

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. 51business income (schedule c) (cont.)

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

If no separate business name, leave blank. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Go to www.irs.gov/schedulec for instructions and the latest information. 51business income (schedule c) (cont.)

2024 Form 1040 Schedule C Ez Glen Philly

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. 51business income (schedule c) (cont.)

Taxes Schedule C Form 1040 (20242025) PDFliner

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. If no separate business name, leave blank. 51business income (schedule c) (cont.) Go to www.irs.gov/schedulec for instructions and the latest information.

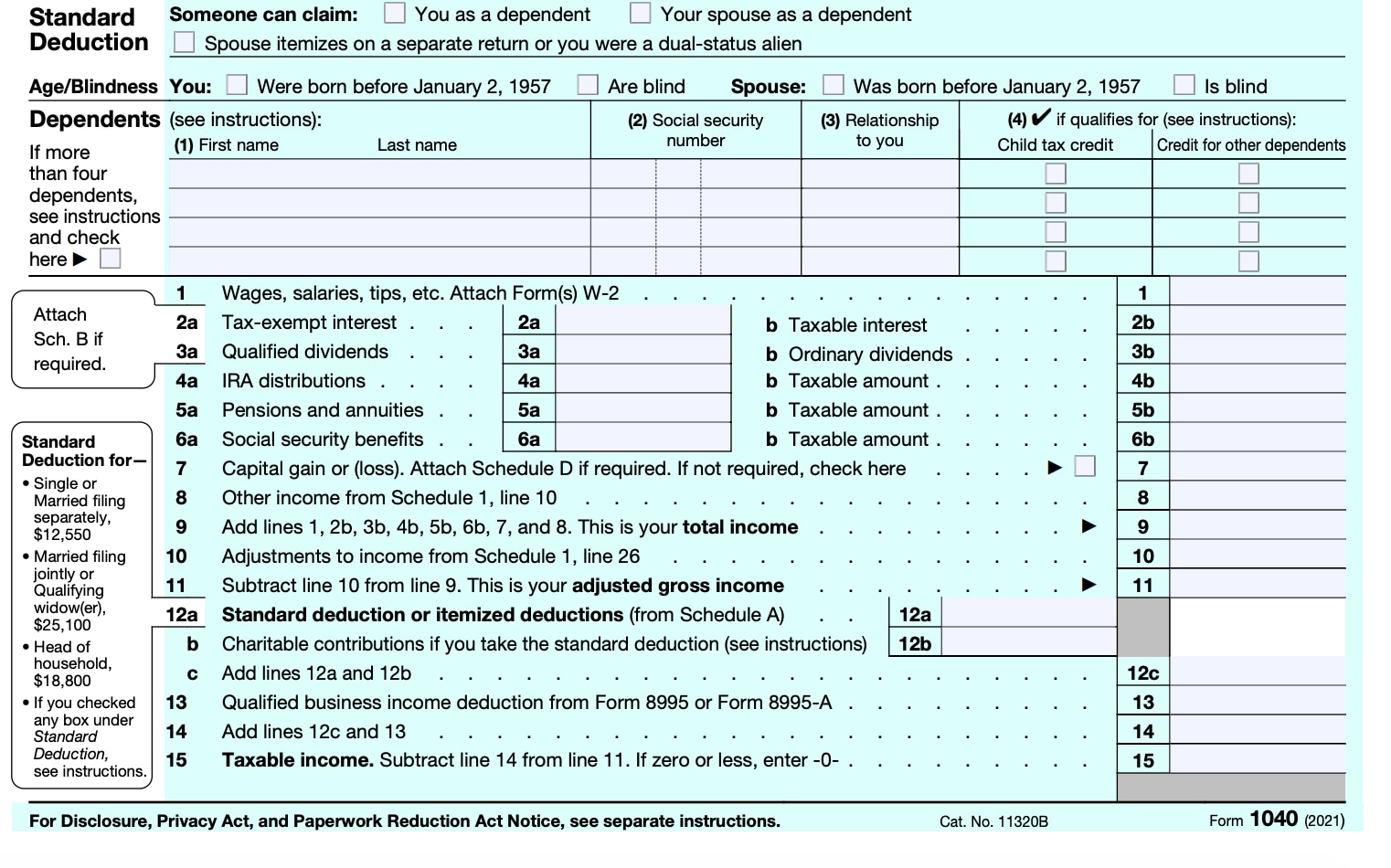

1040 form 2024 Fill out & sign online DocHub

51business income (schedule c) (cont.) The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information.

Schedule C Form 1040 For 2024 Tax nike laurena

If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. 51business income (schedule c) (cont.)

Irs 2024 Form 1040 Schedule C Tasha Fredelia

If no separate business name, leave blank. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. 51business income (schedule c) (cont.) Go to www.irs.gov/schedulec for instructions and the latest information.

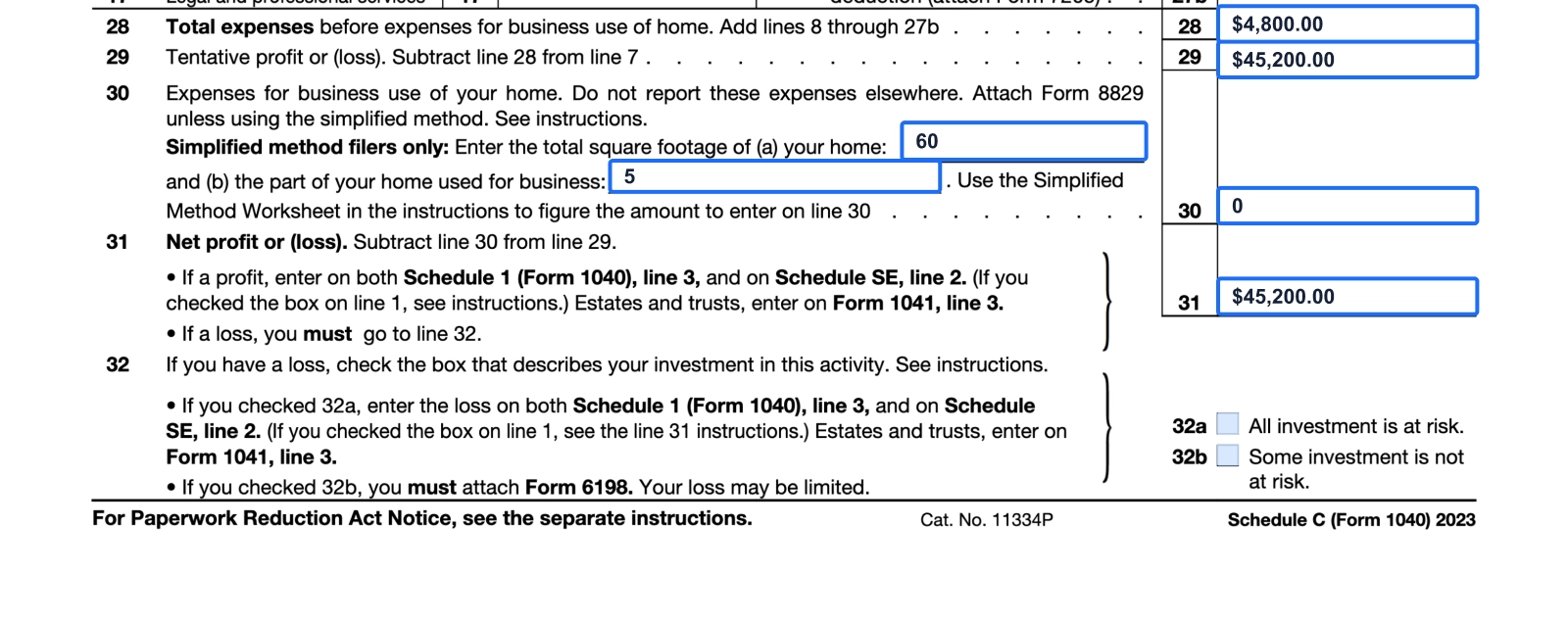

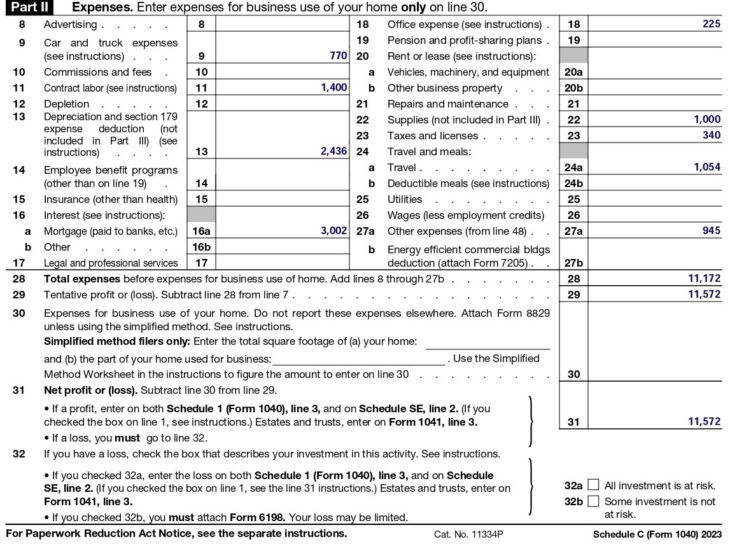

How To Fill Out Schedule C in 2024 (With Example)

If no separate business name, leave blank. 51business income (schedule c) (cont.) The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Go to www.irs.gov/schedulec for instructions and the latest information.

Go To Www.irs.gov/Schedulec For Instructions And The Latest Information.

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. If no separate business name, leave blank. 51business income (schedule c) (cont.)