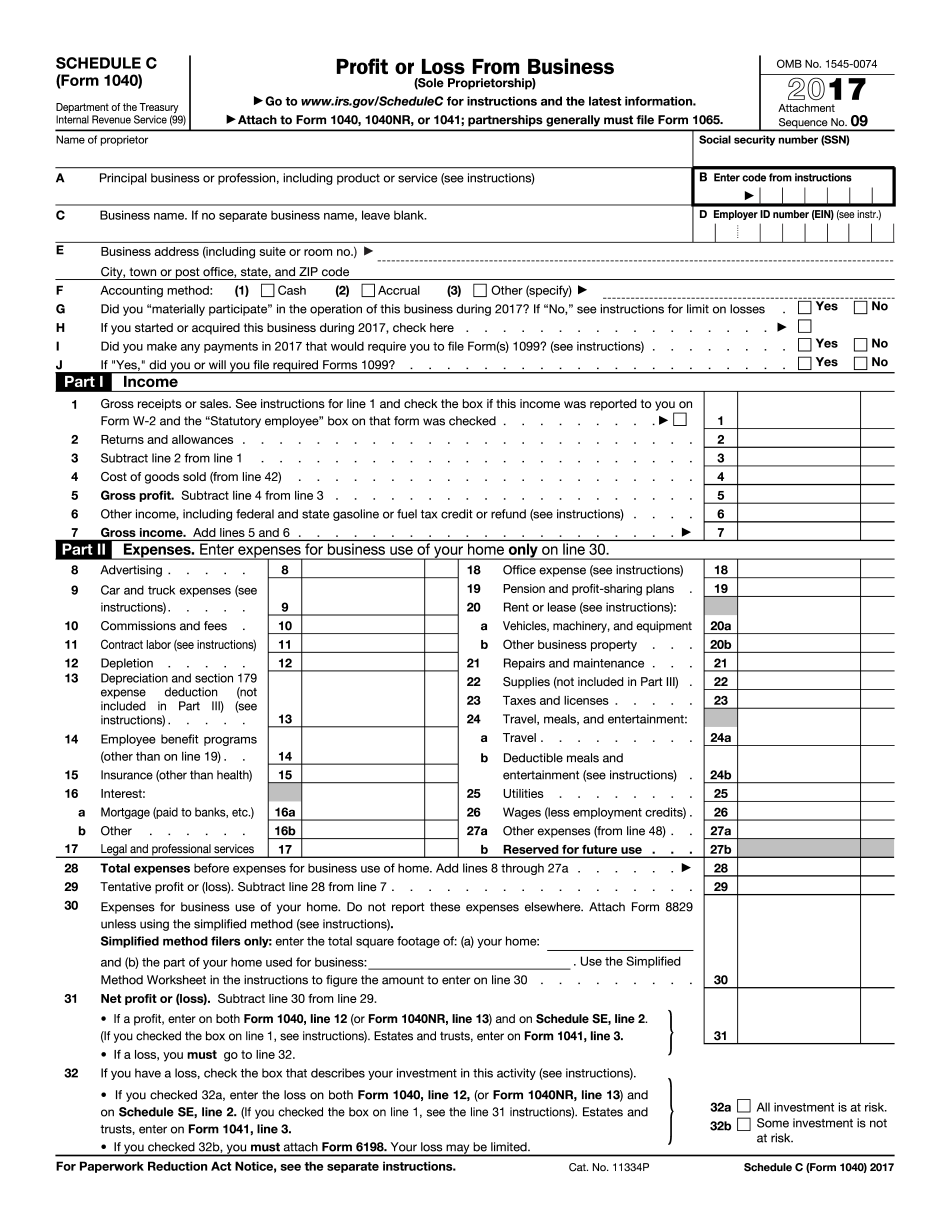

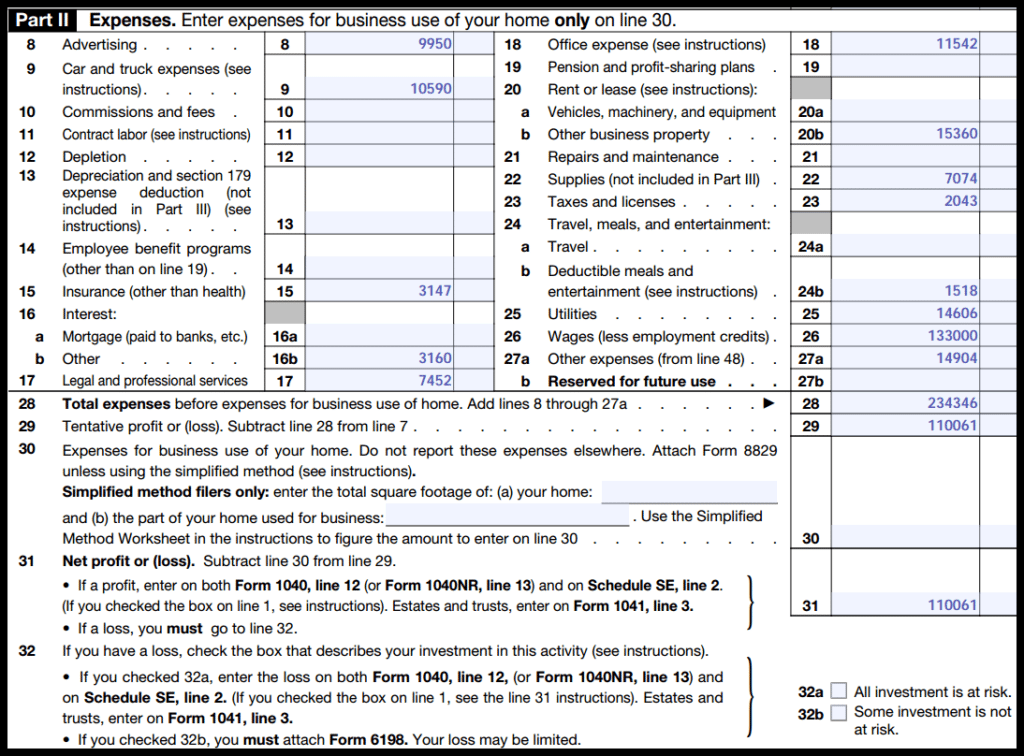

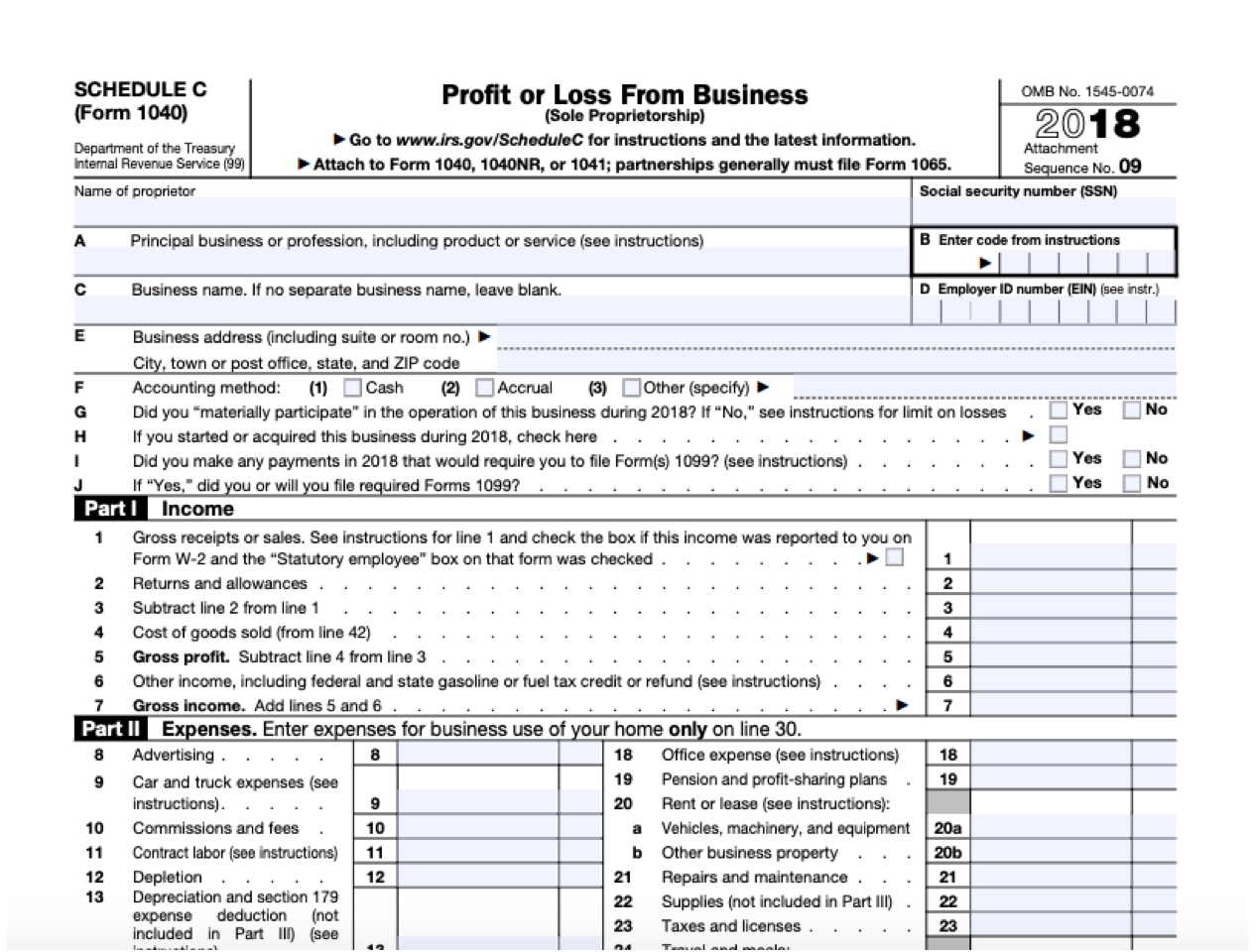

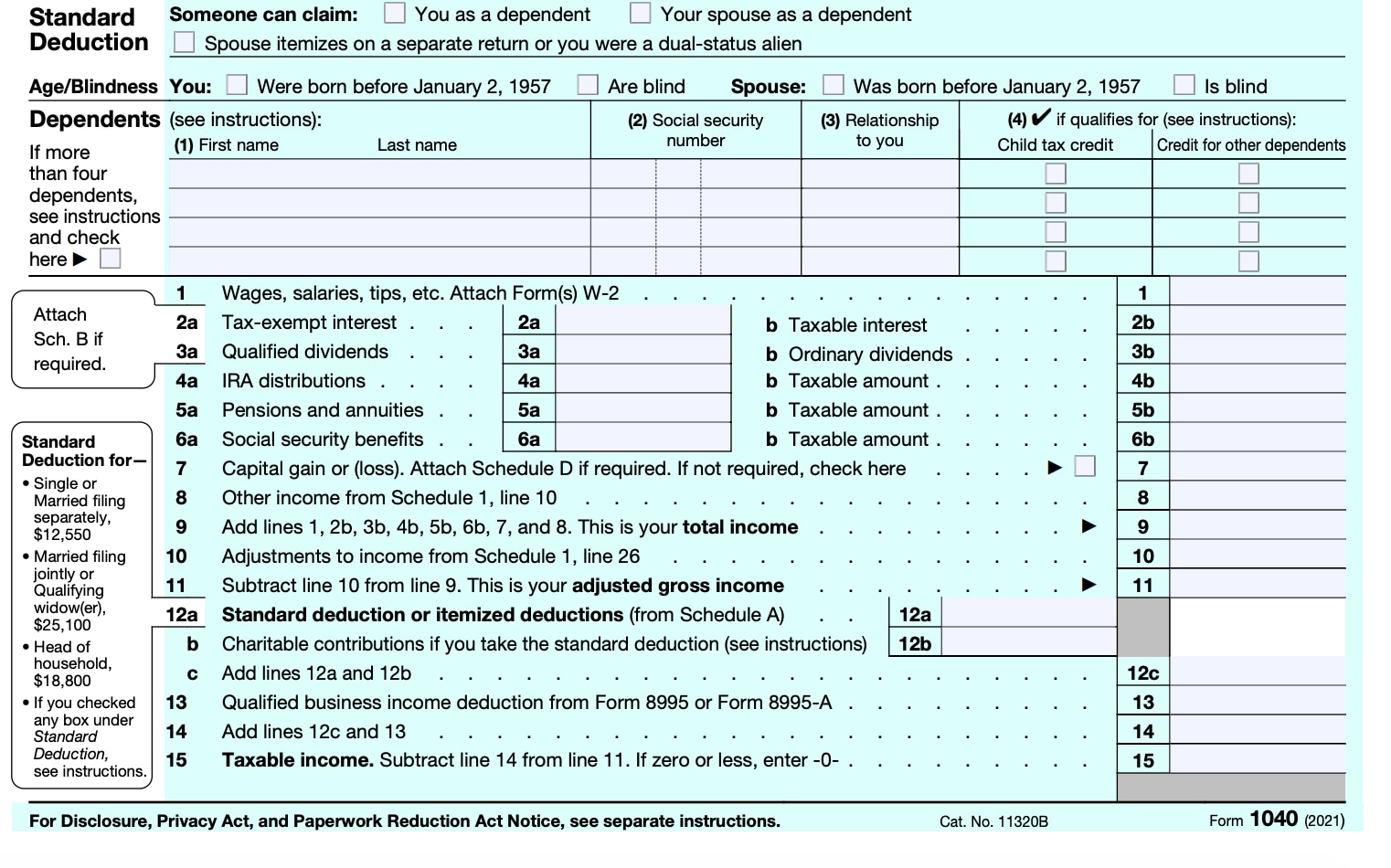

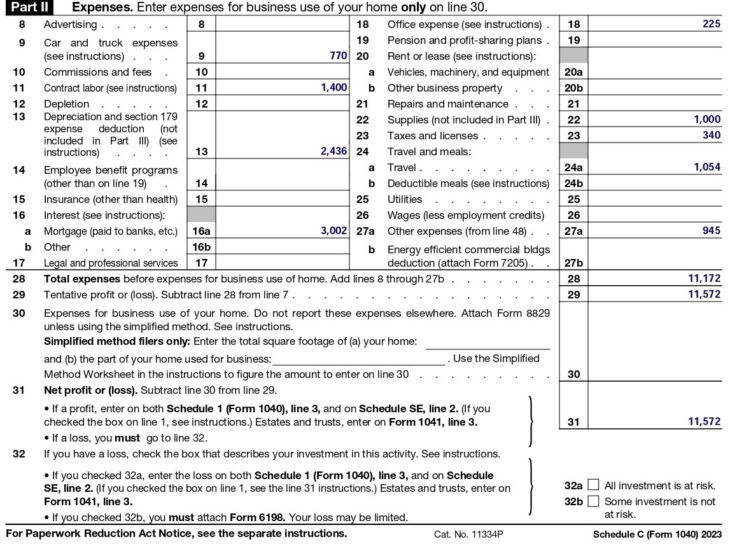

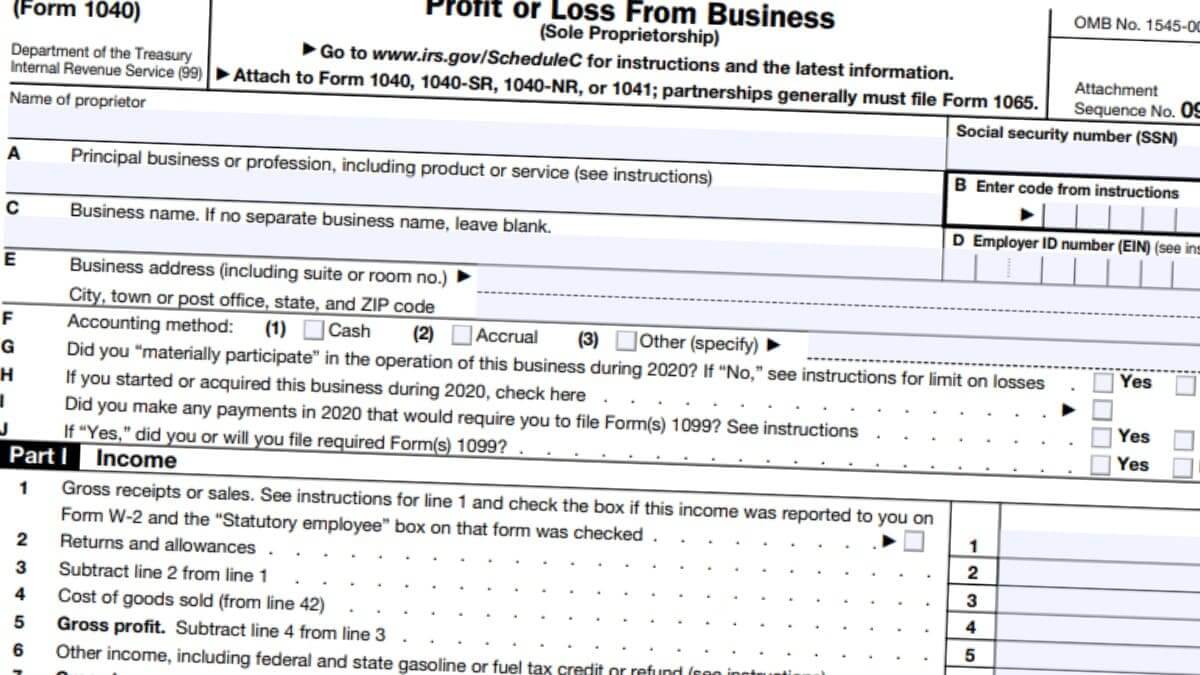

Form 1040 Schedule C 2024 - Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. It includes instructions, lines, and. This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. Learn how to use schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual.

Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). Learn how to use schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual. It includes instructions, lines, and. This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024.

Learn how to use schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual. It includes instructions, lines, and. This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040).

Irs Fillable Forms 2024 Schedule C Penny Blondell

This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). Learn how to use schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated.

2024 Schedule C Form Greta Katalin

This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. Learn how to use schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual. This is the official pdf form for reporting profit or loss from business (sole proprietorship).

Schedule C 2024 Herta Giralda

This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. It includes instructions, lines, and. This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. Learn how to use schedule c to report the income and expenses of a sole proprietorship, which.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. It includes instructions, lines, and. Report income or loss from a business or profession as a sole proprietor using schedule c (form.

2024 Form 1040 Schedule C Instructions Meaning Lydia Rochell

This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). Learn how to use schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated.

Schedule C Form 1040 For 2024 Tax nike laurena

Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. Learn how to use schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated.

How To Fill Out Schedule C in 2024 (With Example)

It includes instructions, lines, and. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. Learn how to use schedule c to report the income and expenses of a sole proprietorship, which is.

2024 Irs Schedule C 2024 Calendar Template Excel

Learn how to use schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual. This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. Report income or loss from a business or profession as a sole proprietor using schedule.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). It includes instructions, lines, and. This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

It includes instructions, lines, and. This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. Report income or loss from a business or profession as a sole proprietor using schedule c (form.

Report Income Or Loss From A Business Or Profession As A Sole Proprietor Using Schedule C (Form 1040).

It includes instructions, lines, and. Learn how to use schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual. This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024.