How To Track Business Income - As a small business, you need to have a full and complete understanding of both your income and expenses. Tracking your expenses allows you to monitor the growth of your business, build financial statements, keep track of deductibles,. By tracking expenses, a business can plan better, anticipate slowdowns in cash flow and make sure the most important business. To track small business expenses effectively, start by opening a. Using software to track your expenses can save you time and money and help your employees operate more efficiently. How do small businesses keep track of expenses? That’s why tracking both is pivotal.

To track small business expenses effectively, start by opening a. As a small business, you need to have a full and complete understanding of both your income and expenses. By tracking expenses, a business can plan better, anticipate slowdowns in cash flow and make sure the most important business. How do small businesses keep track of expenses? Using software to track your expenses can save you time and money and help your employees operate more efficiently. Tracking your expenses allows you to monitor the growth of your business, build financial statements, keep track of deductibles,. That’s why tracking both is pivotal.

That’s why tracking both is pivotal. To track small business expenses effectively, start by opening a. How do small businesses keep track of expenses? Using software to track your expenses can save you time and money and help your employees operate more efficiently. Tracking your expenses allows you to monitor the growth of your business, build financial statements, keep track of deductibles,. As a small business, you need to have a full and complete understanding of both your income and expenses. By tracking expenses, a business can plan better, anticipate slowdowns in cash flow and make sure the most important business.

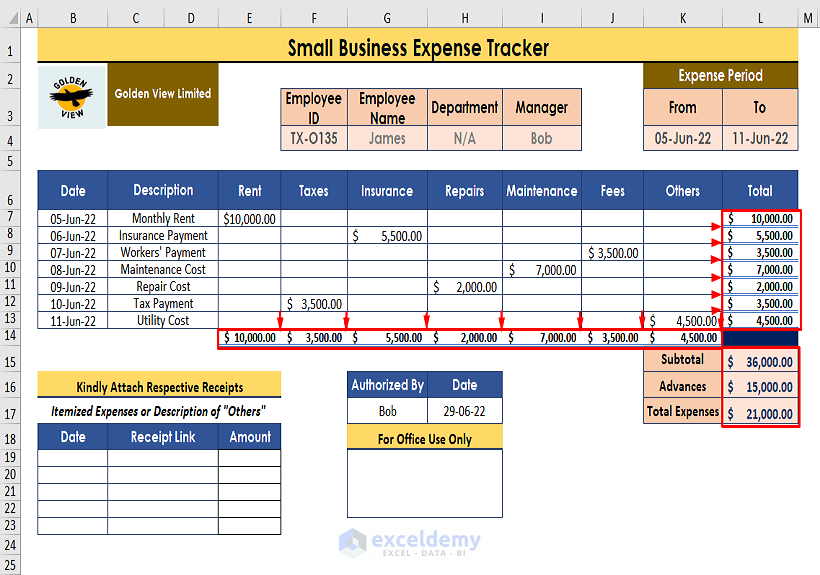

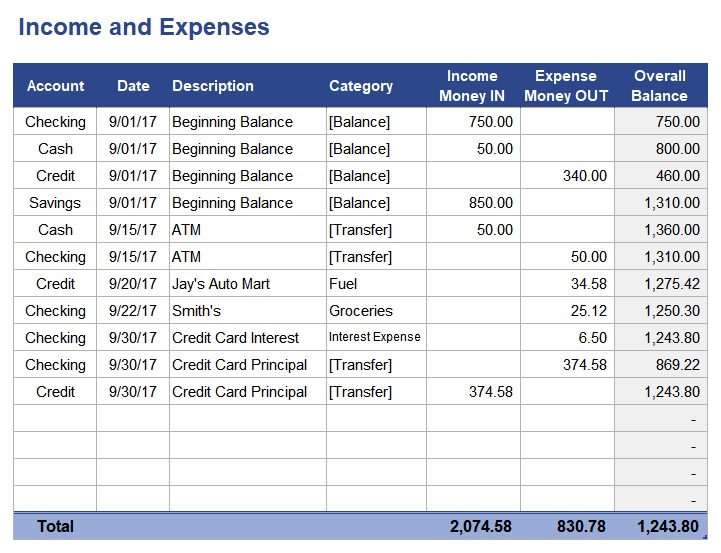

How to Keep Track of Small Business Expenses in Excel (2 Ways)

That’s why tracking both is pivotal. Tracking your expenses allows you to monitor the growth of your business, build financial statements, keep track of deductibles,. As a small business, you need to have a full and complete understanding of both your income and expenses. How do small businesses keep track of expenses? Using software to track your expenses can save.

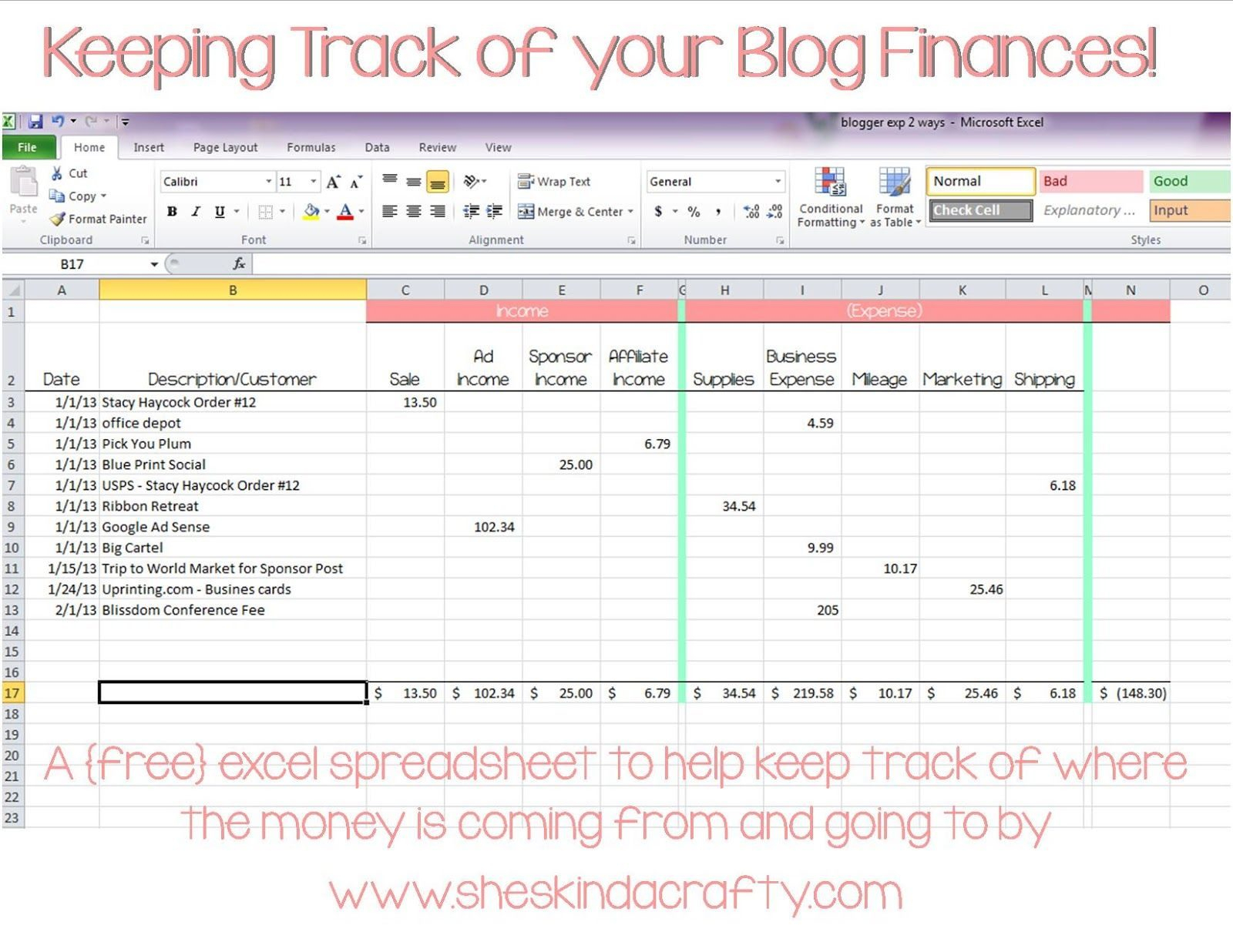

Template To Track Business Expenses

By tracking expenses, a business can plan better, anticipate slowdowns in cash flow and make sure the most important business. As a small business, you need to have a full and complete understanding of both your income and expenses. How do small businesses keep track of expenses? Tracking your expenses allows you to monitor the growth of your business, build.

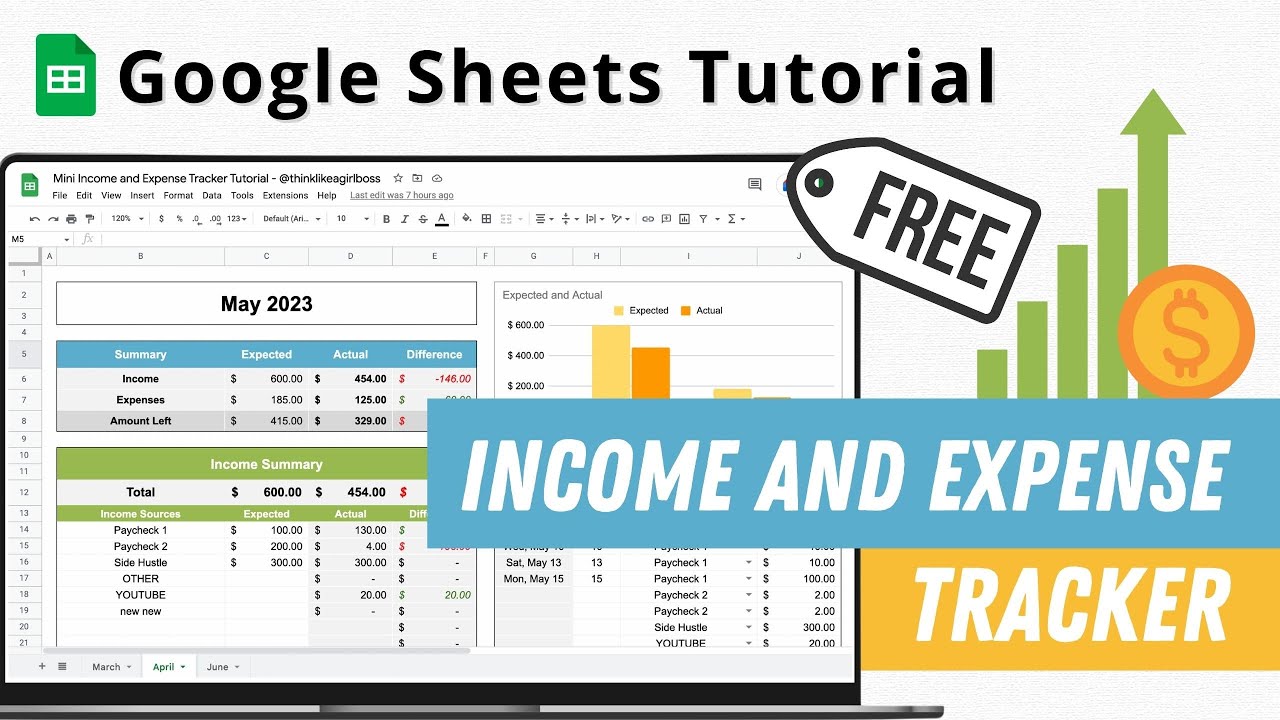

Free And Expense Tracker Templates For Google Sheets And

Using software to track your expenses can save you time and money and help your employees operate more efficiently. How do small businesses keep track of expenses? To track small business expenses effectively, start by opening a. By tracking expenses, a business can plan better, anticipate slowdowns in cash flow and make sure the most important business. As a small.

Excel and expense tracker punchper

Using software to track your expenses can save you time and money and help your employees operate more efficiently. To track small business expenses effectively, start by opening a. Tracking your expenses allows you to monitor the growth of your business, build financial statements, keep track of deductibles,. By tracking expenses, a business can plan better, anticipate slowdowns in cash.

How to Build an and Expense Tracker from Scratch Google Sheets

As a small business, you need to have a full and complete understanding of both your income and expenses. Using software to track your expenses can save you time and money and help your employees operate more efficiently. That’s why tracking both is pivotal. Tracking your expenses allows you to monitor the growth of your business, build financial statements, keep.

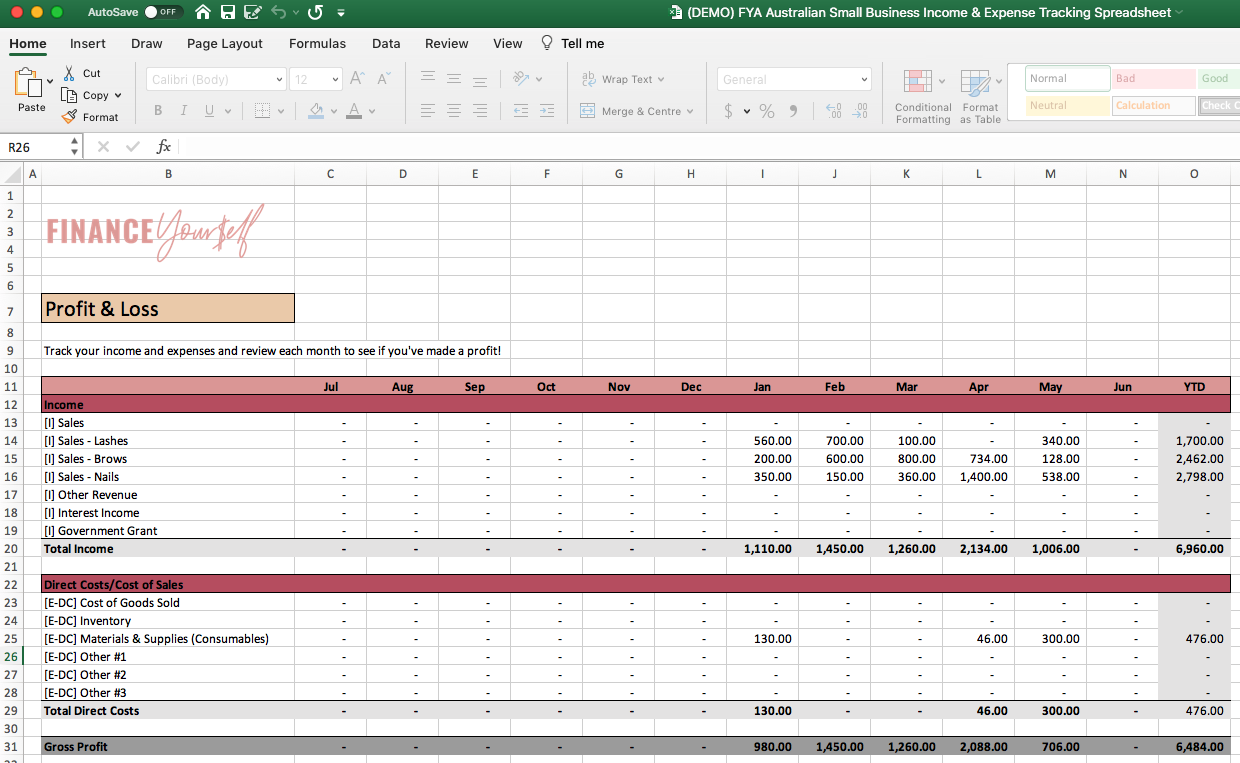

FREE Australian Small Business & Expense Tracking Spreadsheet

To track small business expenses effectively, start by opening a. That’s why tracking both is pivotal. Using software to track your expenses can save you time and money and help your employees operate more efficiently. Tracking your expenses allows you to monitor the growth of your business, build financial statements, keep track of deductibles,. By tracking expenses, a business can.

Monthly business and expense template masvlero

To track small business expenses effectively, start by opening a. As a small business, you need to have a full and complete understanding of both your income and expenses. By tracking expenses, a business can plan better, anticipate slowdowns in cash flow and make sure the most important business. That’s why tracking both is pivotal. Using software to track your.

Simple spreadsheets to keep track of business and expenses for

To track small business expenses effectively, start by opening a. By tracking expenses, a business can plan better, anticipate slowdowns in cash flow and make sure the most important business. How do small businesses keep track of expenses? Tracking your expenses allows you to monitor the growth of your business, build financial statements, keep track of deductibles,. That’s why tracking.

Free Template Excel Spreadsheet for Business Expenses

Tracking your expenses allows you to monitor the growth of your business, build financial statements, keep track of deductibles,. As a small business, you need to have a full and complete understanding of both your income and expenses. That’s why tracking both is pivotal. Using software to track your expenses can save you time and money and help your employees.

Small business and expense tracker gertynano

Using software to track your expenses can save you time and money and help your employees operate more efficiently. That’s why tracking both is pivotal. By tracking expenses, a business can plan better, anticipate slowdowns in cash flow and make sure the most important business. As a small business, you need to have a full and complete understanding of both.

That’s Why Tracking Both Is Pivotal.

To track small business expenses effectively, start by opening a. Using software to track your expenses can save you time and money and help your employees operate more efficiently. As a small business, you need to have a full and complete understanding of both your income and expenses. How do small businesses keep track of expenses?

Tracking Your Expenses Allows You To Monitor The Growth Of Your Business, Build Financial Statements, Keep Track Of Deductibles,.

By tracking expenses, a business can plan better, anticipate slowdowns in cash flow and make sure the most important business.