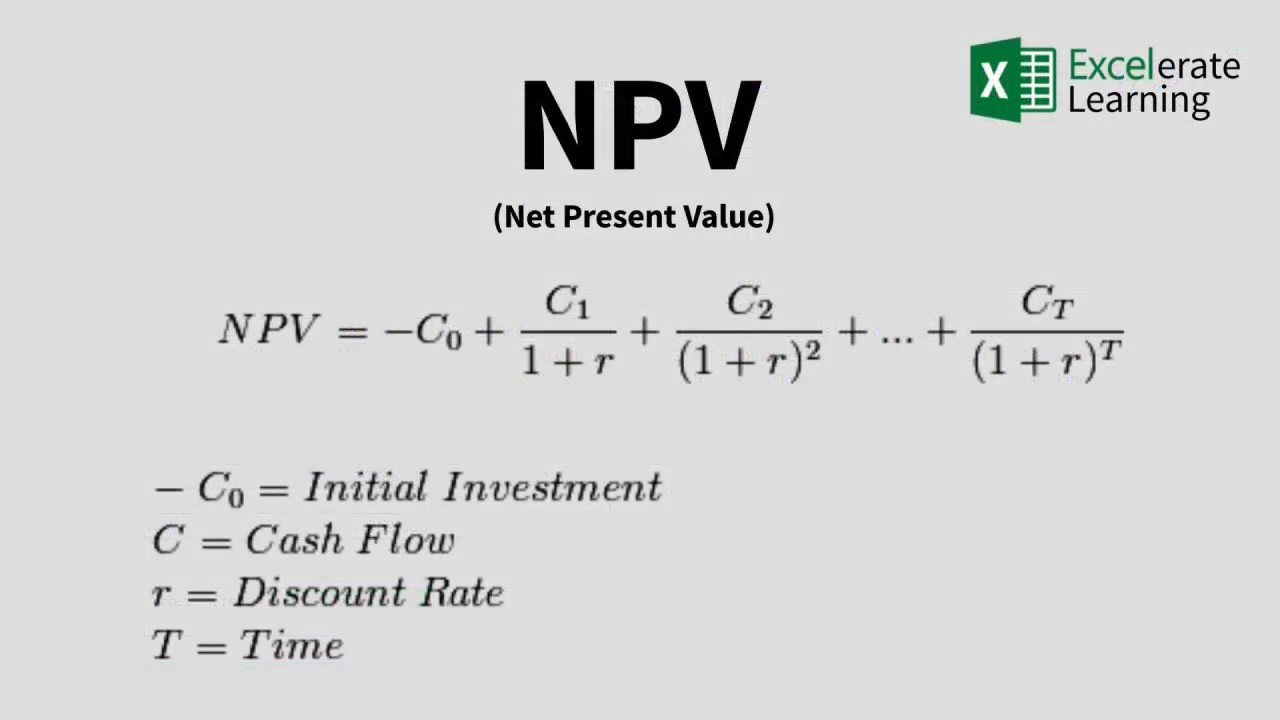

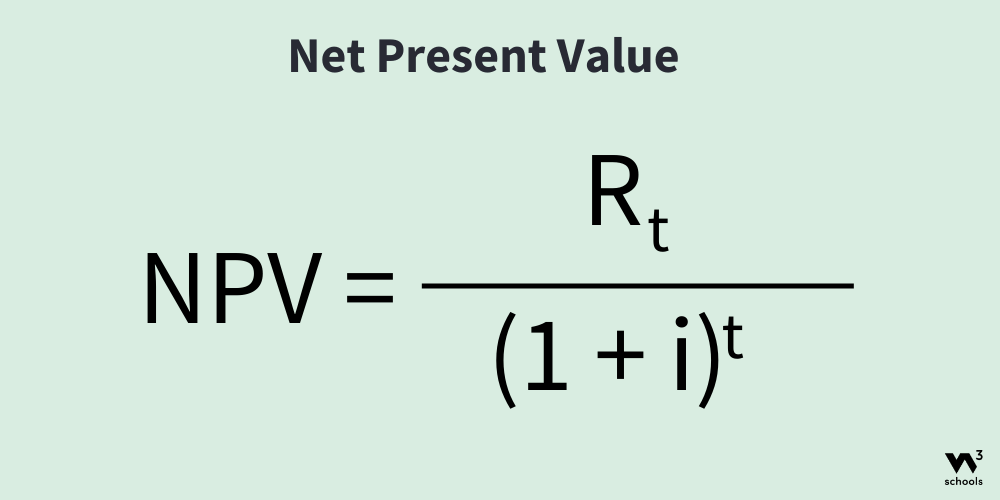

Npv Formula Excel Monthly Cash Flows - From the official documentation of the xnpv function, it requires a rate (which looks to be an annual discount rate), a range of cash. We will demonstrate 3 different examples of using. We will use this function to write an npv formula for monthly cash flows in excel. Npv calculates that present value for each of the series of cash flows and adds them together to get the net present value.

We will use this function to write an npv formula for monthly cash flows in excel. Npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. From the official documentation of the xnpv function, it requires a rate (which looks to be an annual discount rate), a range of cash. We will demonstrate 3 different examples of using.

We will use this function to write an npv formula for monthly cash flows in excel. Npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. From the official documentation of the xnpv function, it requires a rate (which looks to be an annual discount rate), a range of cash. We will demonstrate 3 different examples of using.

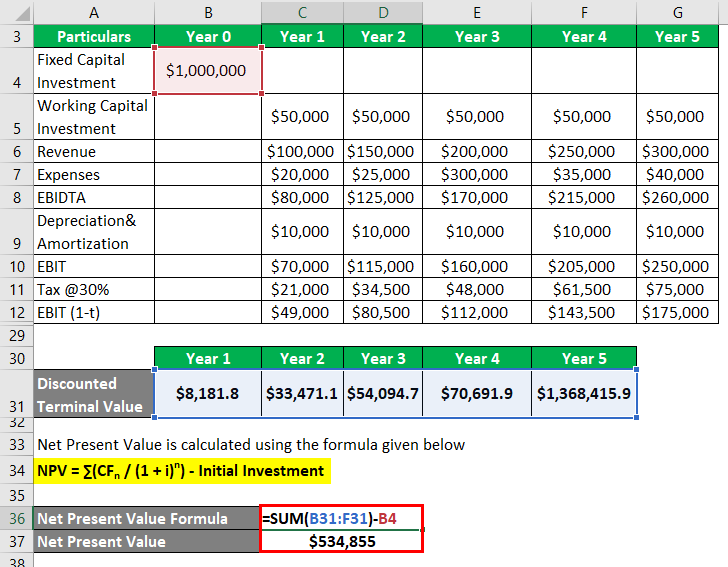

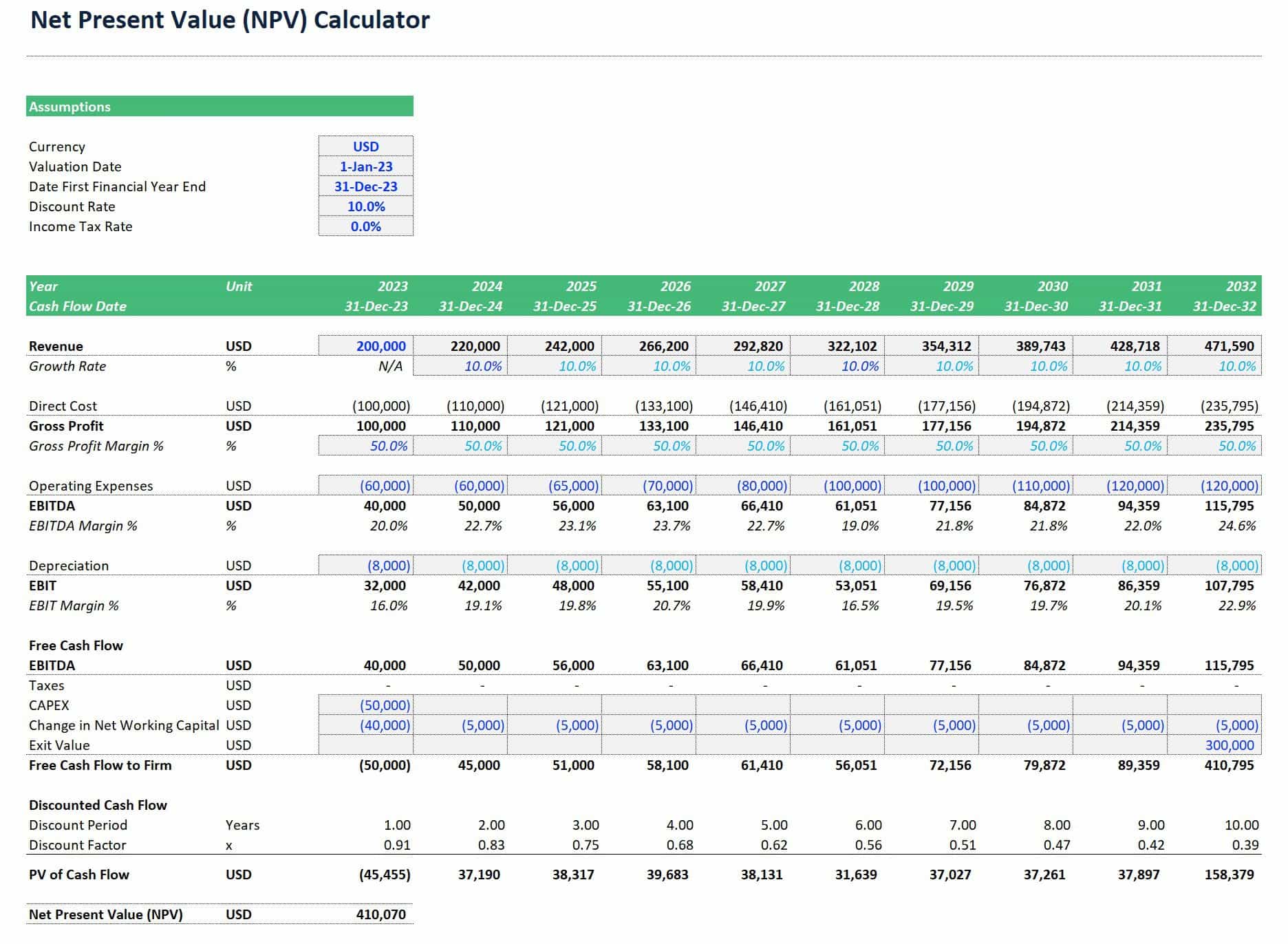

Net Present Value Excel Template

Npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. We will use this function to write an npv formula for monthly cash flows in excel. From the official documentation of the xnpv function, it requires a rate (which looks to be an annual discount rate), a.

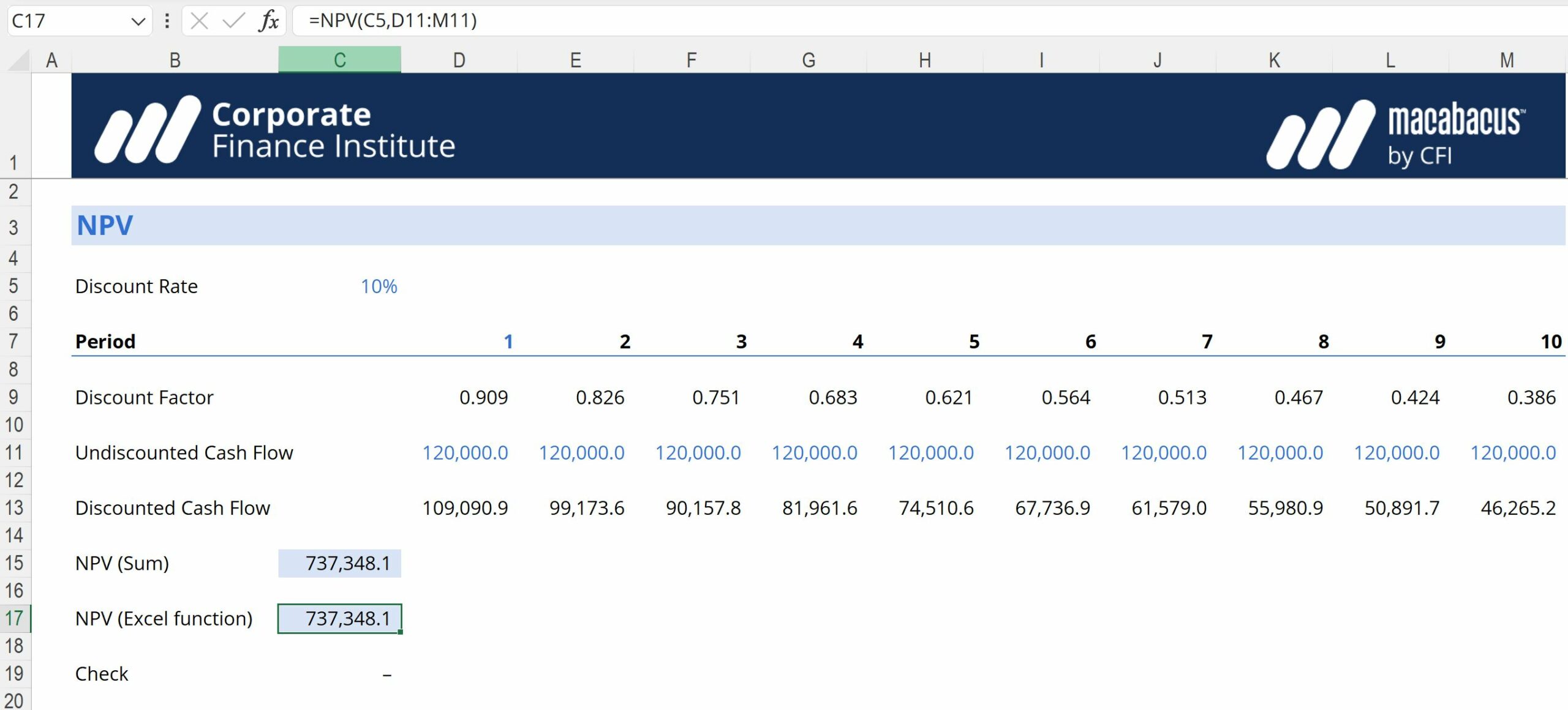

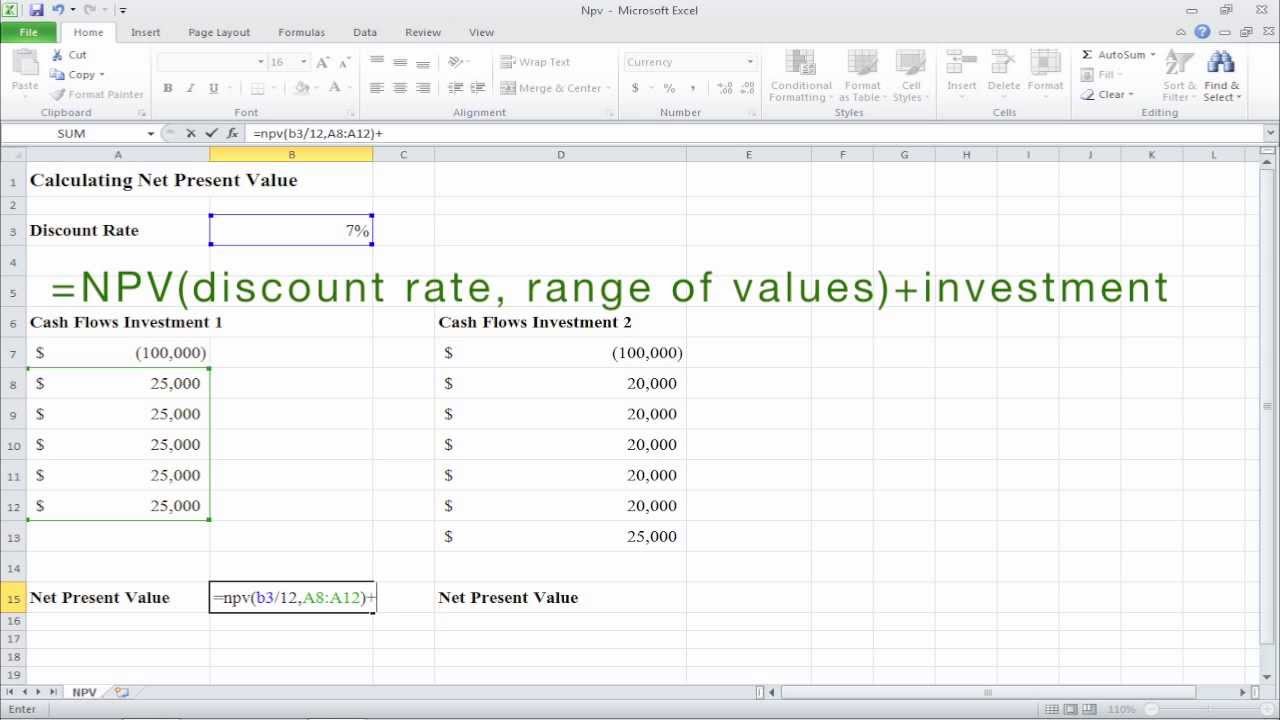

NPV Function Formula, Examples, How to Calculate NPV in Excel

Npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. We will use this function to write an npv formula for monthly cash flows in excel. We will demonstrate 3 different examples of using. From the official documentation of the xnpv function, it requires a rate (which.

How to Use NPV in Excel to Calculate the Present Value of Future Cash

Npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. From the official documentation of the xnpv function, it requires a rate (which looks to be an annual discount rate), a range of cash. We will use this function to write an npv formula for monthly cash.

How to Calculate NPV Using Excel

From the official documentation of the xnpv function, it requires a rate (which looks to be an annual discount rate), a range of cash. Npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. We will use this function to write an npv formula for monthly cash.

Net Present Value Excel Template

Npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. From the official documentation of the xnpv function, it requires a rate (which looks to be an annual discount rate), a range of cash. We will demonstrate 3 different examples of using. We will use this function.

Net Present Value Calculator in Excel eFinancialModels

From the official documentation of the xnpv function, it requires a rate (which looks to be an annual discount rate), a range of cash. We will demonstrate 3 different examples of using. Npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. We will use this function.

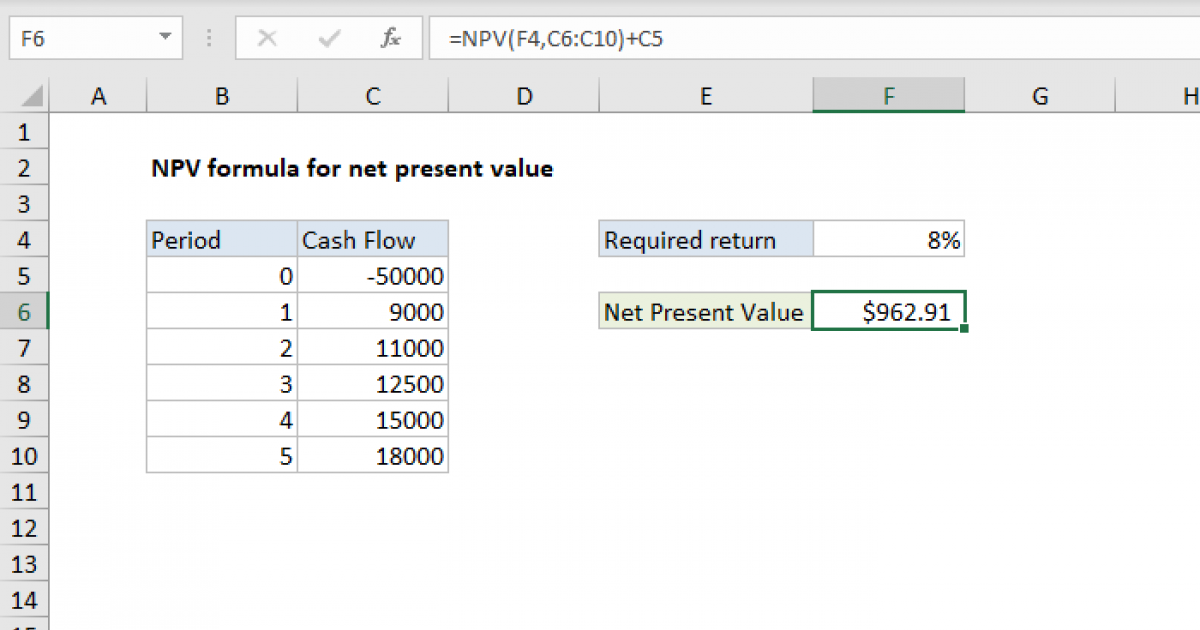

Net Present Value Calculation In Excel Raisa Blog

Npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. We will use this function to write an npv formula for monthly cash flows in excel. From the official documentation of the xnpv function, it requires a rate (which looks to be an annual discount rate), a.

Calculate NPV for Monthly Cash Flows with Formula in Excel

From the official documentation of the xnpv function, it requires a rate (which looks to be an annual discount rate), a range of cash. Npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. We will use this function to write an npv formula for monthly cash.

Net Present Value Excel Template

Npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. We will demonstrate 3 different examples of using. From the official documentation of the xnpv function, it requires a rate (which looks to be an annual discount rate), a range of cash. We will use this function.

NPV formula for net present value Excel formula Exceljet

From the official documentation of the xnpv function, it requires a rate (which looks to be an annual discount rate), a range of cash. We will use this function to write an npv formula for monthly cash flows in excel. Npv calculates that present value for each of the series of cash flows and adds them together to get the.

We Will Use This Function To Write An Npv Formula For Monthly Cash Flows In Excel.

From the official documentation of the xnpv function, it requires a rate (which looks to be an annual discount rate), a range of cash. We will demonstrate 3 different examples of using. Npv calculates that present value for each of the series of cash flows and adds them together to get the net present value.