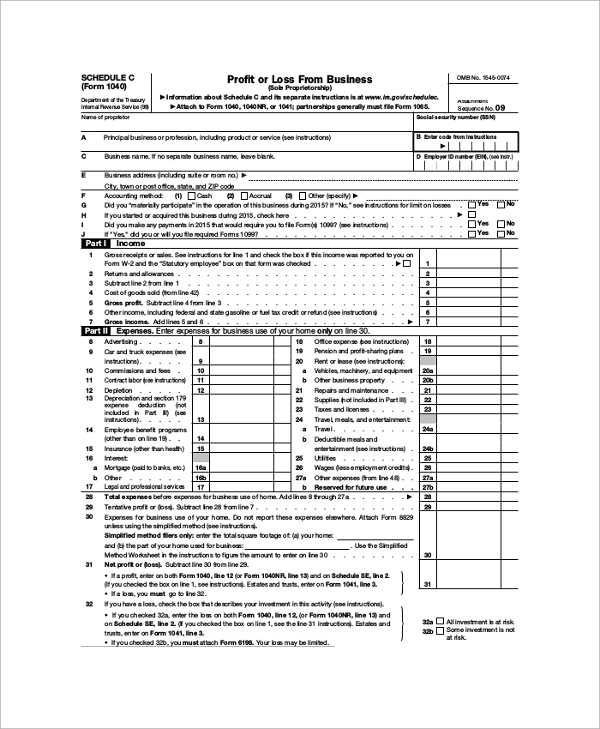

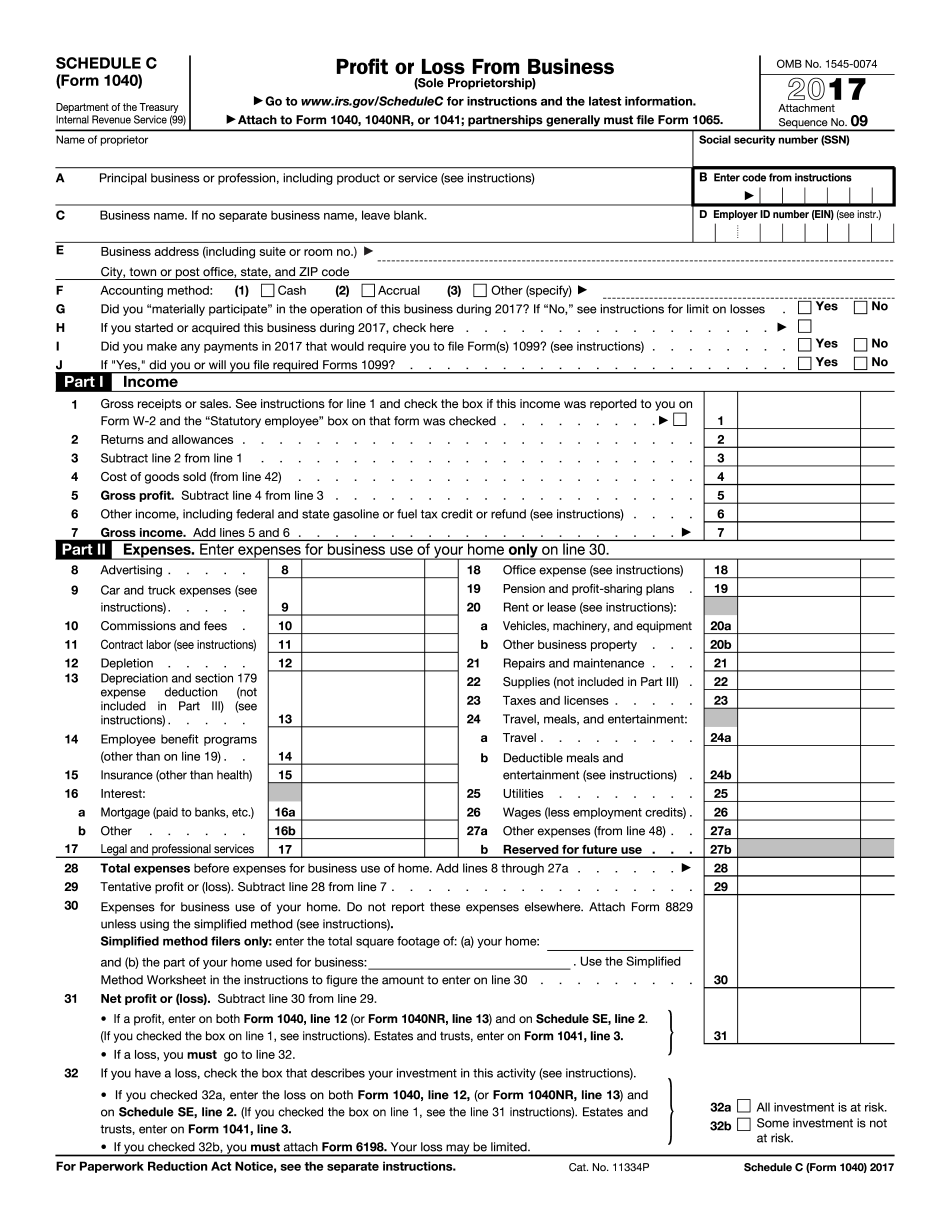

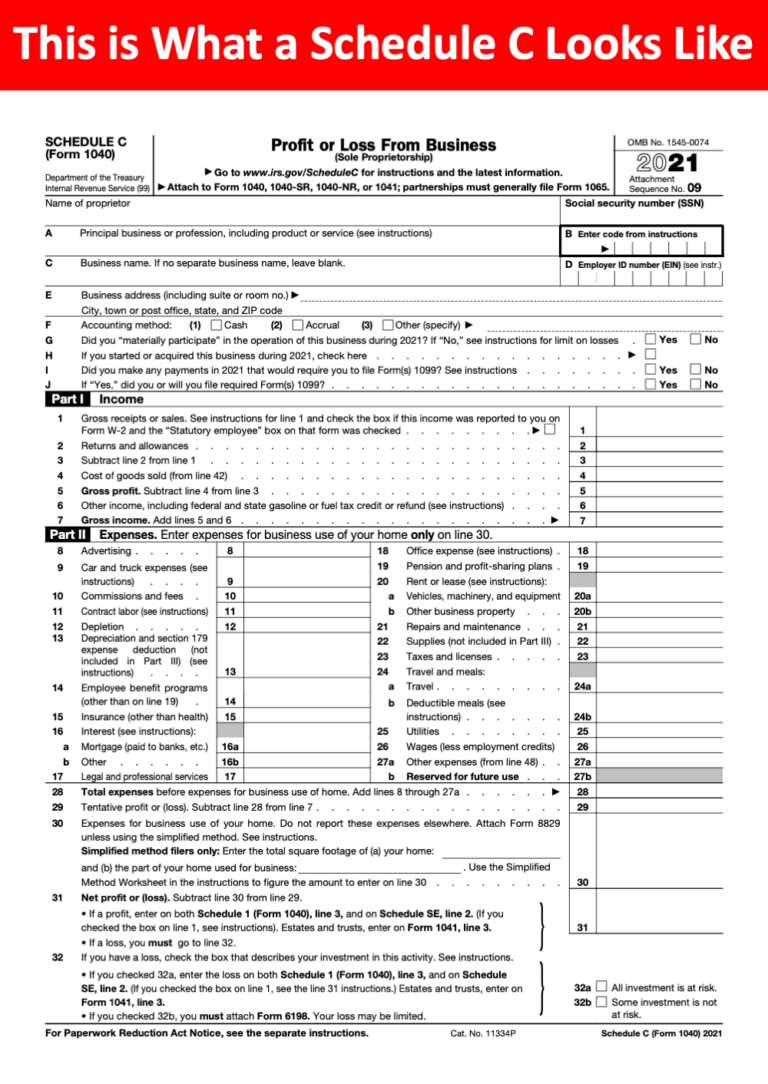

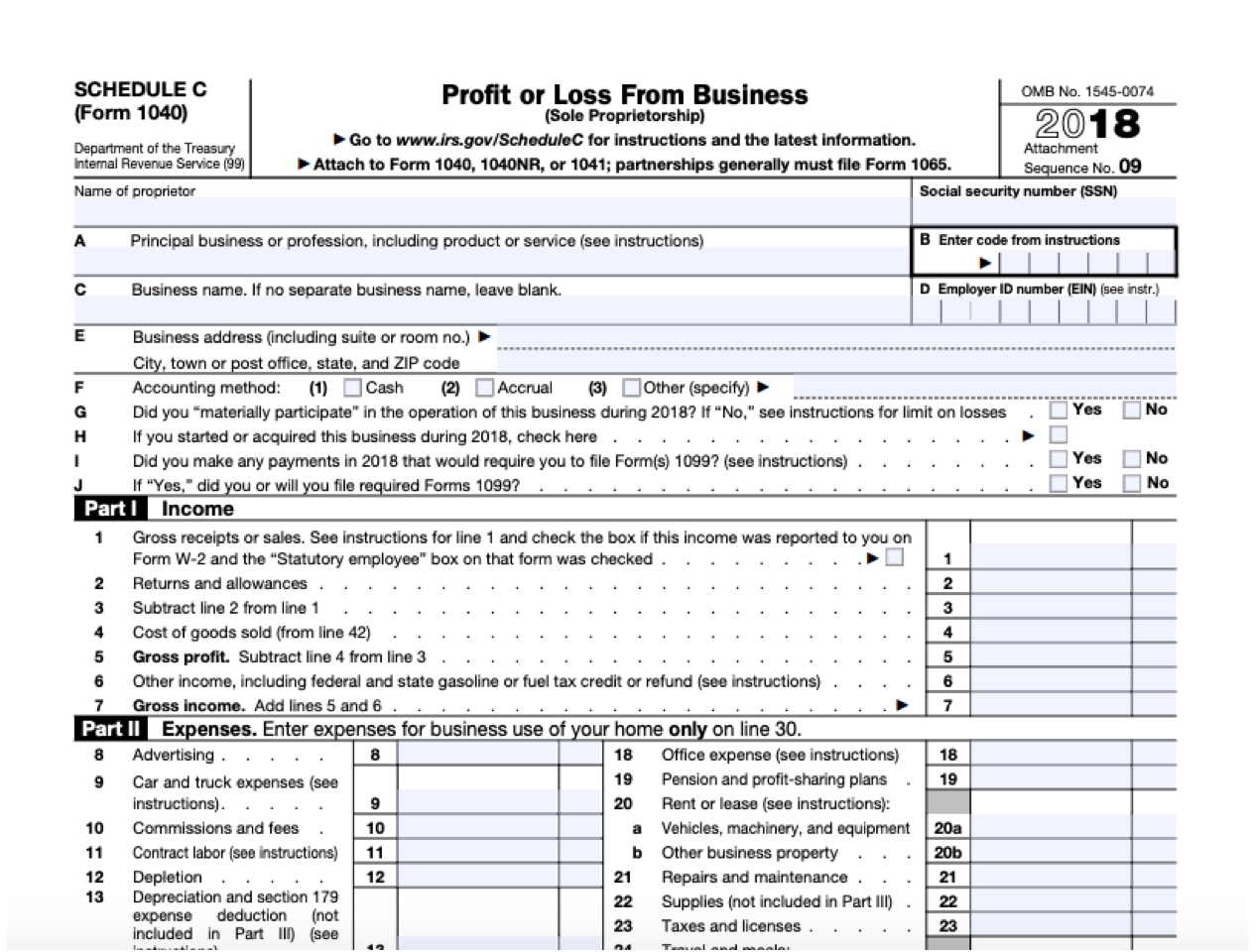

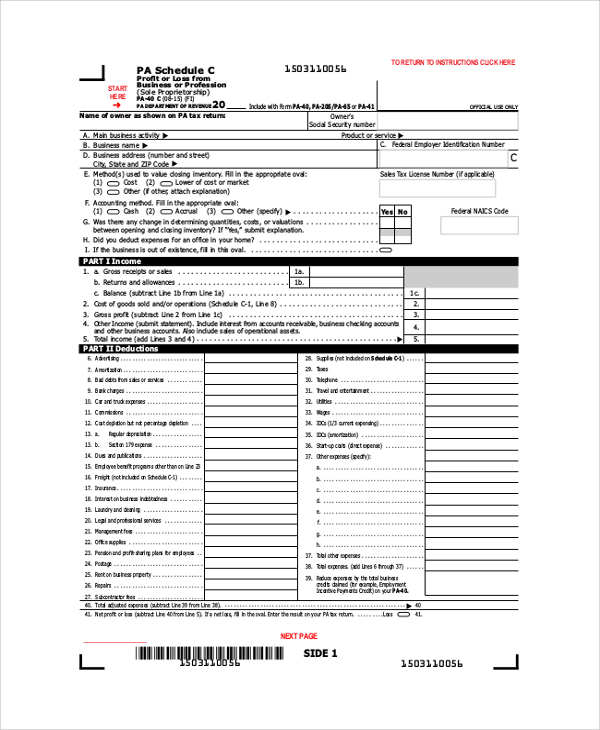

Schedule C 2024 Free Printable - Payments of $600 or more were paid to an individual, who is not your employee, for services provided for this business. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. If yes, did you file. (if you checked the box on. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal.

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. If yes, did you file. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. (if you checked the box on. Payments of $600 or more were paid to an individual, who is not your employee, for services provided for this business. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule.

Payments of $600 or more were paid to an individual, who is not your employee, for services provided for this business. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. If yes, did you file. (if you checked the box on. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule.

Schedule C Printable Guide

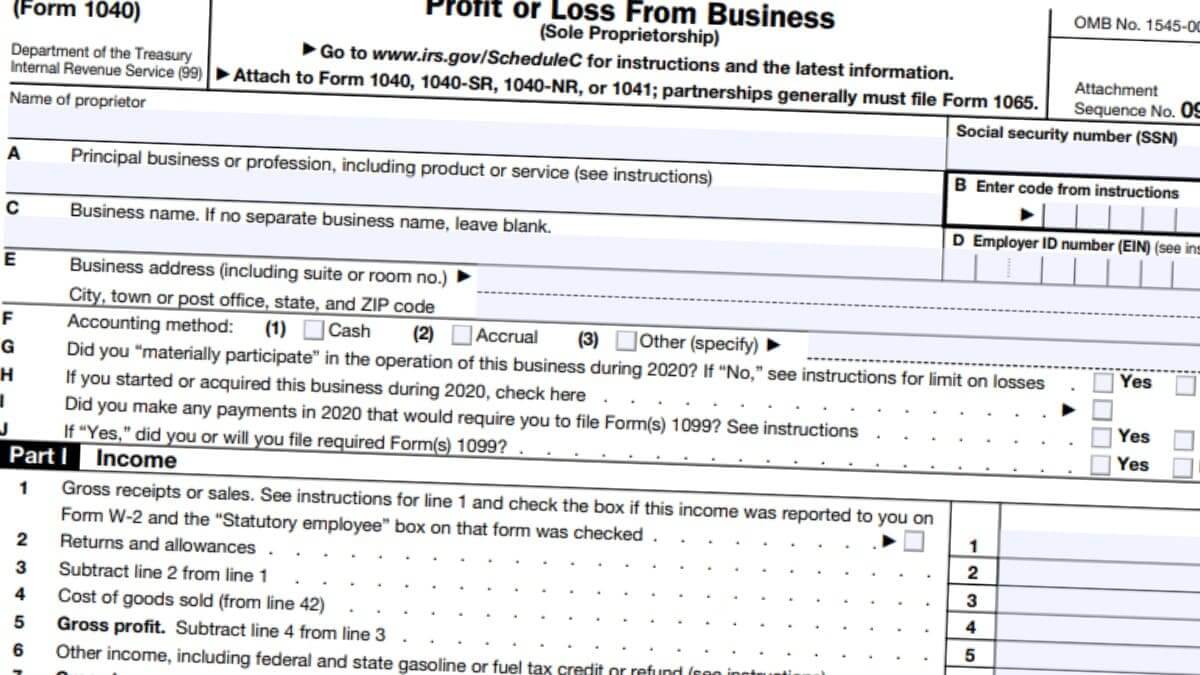

If yes, did you file. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. Payments of $600 or more were paid to an individual, who is not your employee, for services provided for this business. Schedule c worksheet for self employed businesses and/or independent contractors irs requires.

2024 Irs Schedule C 2024 Calendar Template Excel

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Payments of $600 or more were paid to an individual, who is not your employee, for services provided.

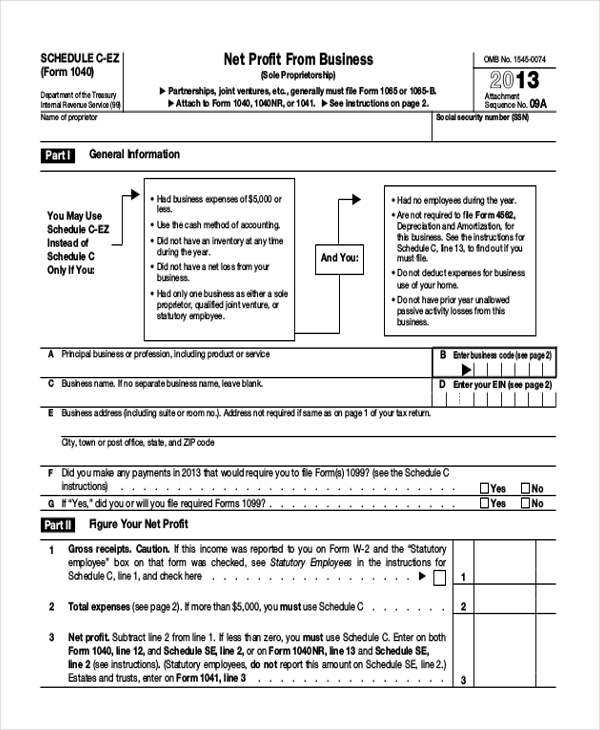

2024 Schedule C Or CEz Schedule C 2024

(if you checked the box on. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. If yes, did you file. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. Payments of $600 or more.

Free Printable Schedule C Tax Form

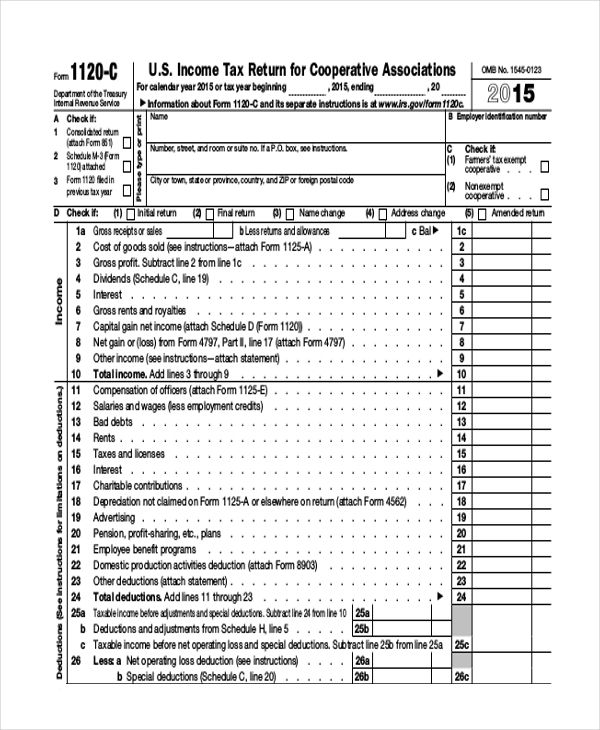

Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Payments of $600 or more were paid to an individual, who is not your employee, for.

Irs Fillable Forms 2024 Schedule C Penny Blondell

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Payments of $600 or more were paid to an individual, who is not your employee, for services provided for this business. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to.

Irs Schedule C Instructions For 2024 Printable Deena Eveleen

If yes, did you file. Payments of $600 or more were paid to an individual, who is not your employee, for services provided for this business. (if you checked the box on. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. • if you checked 32a, enter the loss.

Irs Schedule C 2024 Tove Ainslie

Payments of $600 or more were paid to an individual, who is not your employee, for services provided for this business. If yes, did you file. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Download or print the 2024 federal (profit or loss from business (sole.

2024 Schedule C Form Orel Tracey

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. If yes, did you file. (if you checked the box on. Payments of $600 or more were paid to an individual, who is not your employee, for services provided for this business. • if you checked 32a, enter the loss.

2024 Schedule C Form Orel Tracey

(if you checked the box on. Payments of $600 or more were paid to an individual, who is not your employee, for services provided for this business. If yes, did you file. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Download or print the 2024 federal (profit or.

Schedule C Deductions 2024 Form Nita Terese

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. (if you checked the box on. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. If yes, did you file. Payments of $600 or more.

Payments Of $600 Or More Were Paid To An Individual, Who Is Not Your Employee, For Services Provided For This Business.

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. If yes, did you file. (if you checked the box on. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2.