Schedule C 2024 Worksheet - Please complete this form and. Net profit or (loss) buildings and machinery sold outright (no trades): It is important that the information you provide is summarized in the categories that are indicated on schedule c. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written.

It is important that the information you provide is summarized in the categories that are indicated on schedule c. Net profit or (loss) buildings and machinery sold outright (no trades): I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Please complete this form and. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule.

Net profit or (loss) buildings and machinery sold outright (no trades): Please complete this form and. It is important that the information you provide is summarized in the categories that are indicated on schedule c. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written.

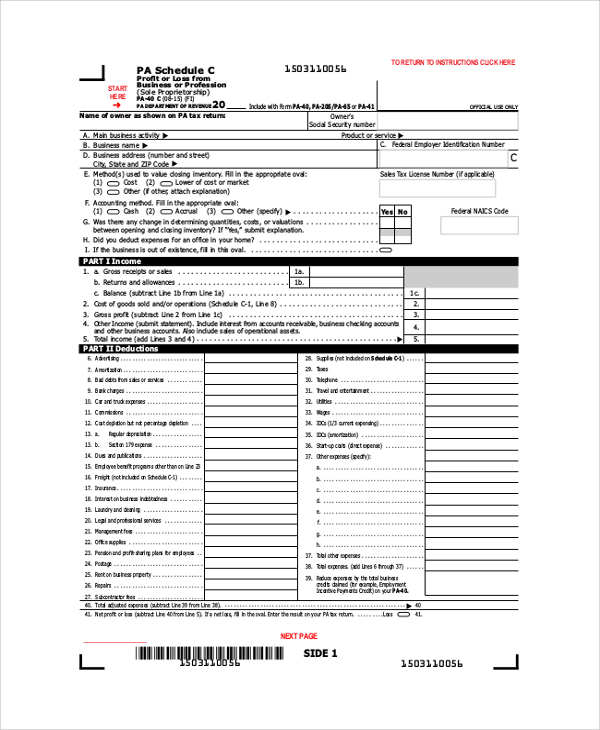

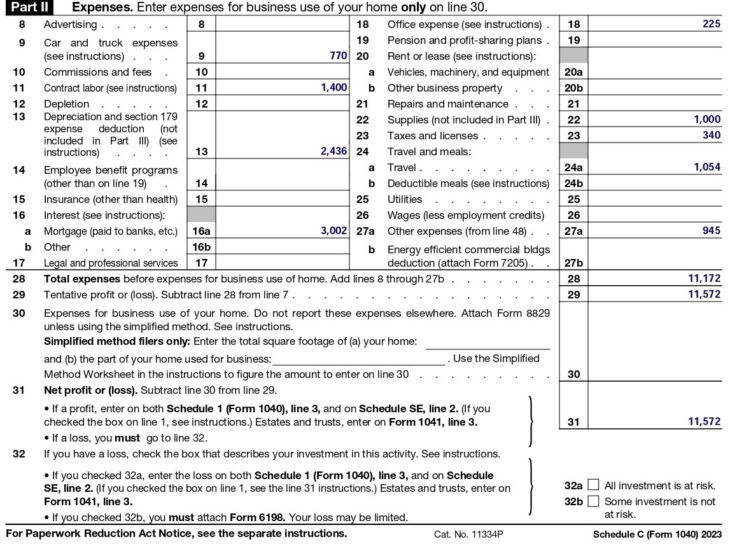

Irs Fillable Forms 2024 Schedule C Penny Blondell

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Please complete this form and. Net profit or (loss) buildings and machinery sold outright (no trades): It is important that the information you provide is summarized in the categories that are indicated on schedule c. Schedule c worksheet for self employed businesses.

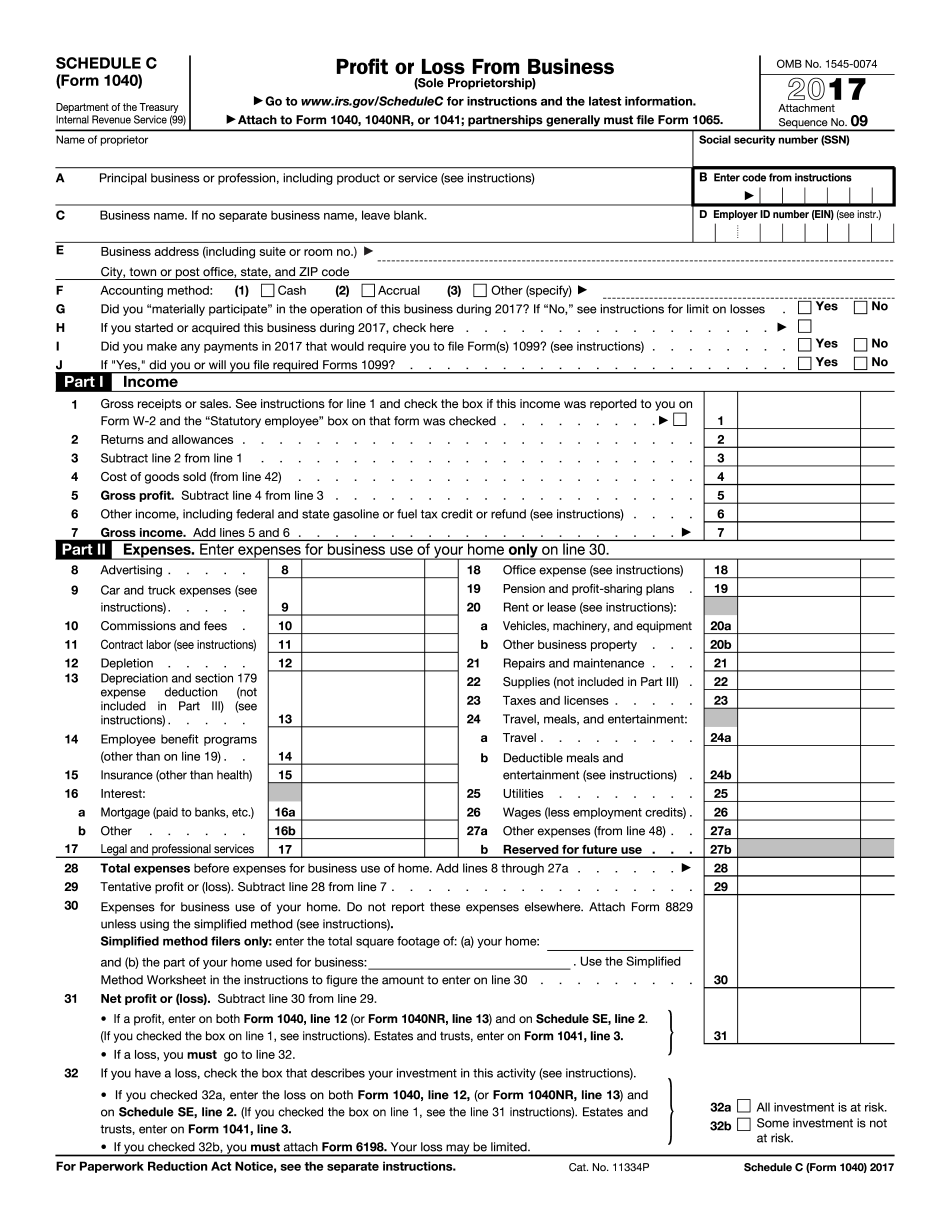

2024 Schedule C Form Orel Tracey

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Please complete this form and. Net profit or (loss) buildings and machinery sold outright (no trades): It is important that the information you provide is summarized in the categories that are indicated on schedule c. I hereby verify that the.

Schedule C Deductions 2024 Form Nita Terese

Net profit or (loss) buildings and machinery sold outright (no trades): Please complete this form and. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. It is important that the information you provide is summarized in the categories that are indicated on schedule c. Schedule c worksheet for self employed businesses.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

Please complete this form and. Net profit or (loss) buildings and machinery sold outright (no trades): Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. It is important that the information.

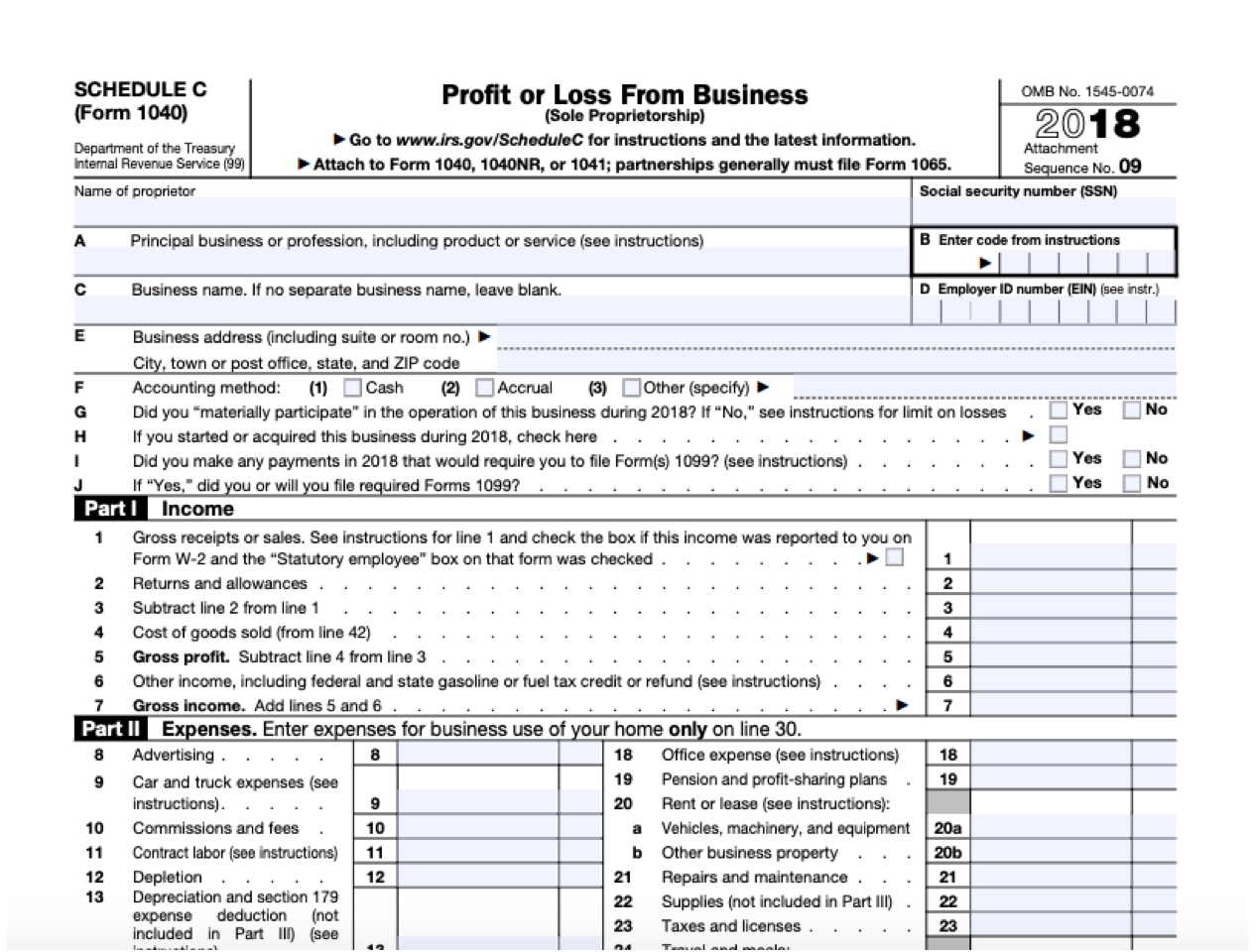

2024 Schedule C Form Maren Florentia

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Net profit or (loss) buildings and machinery sold outright (no trades): Please complete this form and. It is important that the information you provide is summarized in the categories that are indicated on schedule c. I hereby verify that the.

How To Fill Out Schedule C in 2024 (With Example)

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Please complete this form and. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. It is important that the information you provide is summarized in the categories that are indicated on.

Instructions For Schedule C 2024 Emmy Sissie

Net profit or (loss) buildings and machinery sold outright (no trades): It is important that the information you provide is summarized in the categories that are indicated on schedule c. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. I hereby verify that the income and expense information set.

2024 Schedule C Form Orel Tracey

Net profit or (loss) buildings and machinery sold outright (no trades): It is important that the information you provide is summarized in the categories that are indicated on schedule c. Please complete this form and. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. I hereby verify that the.

Schedule C Small Business Organizer Daniel Ahart Tax Service

Please complete this form and. Net profit or (loss) buildings and machinery sold outright (no trades): It is important that the information you provide is summarized in the categories that are indicated on schedule c. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. I hereby verify that the.

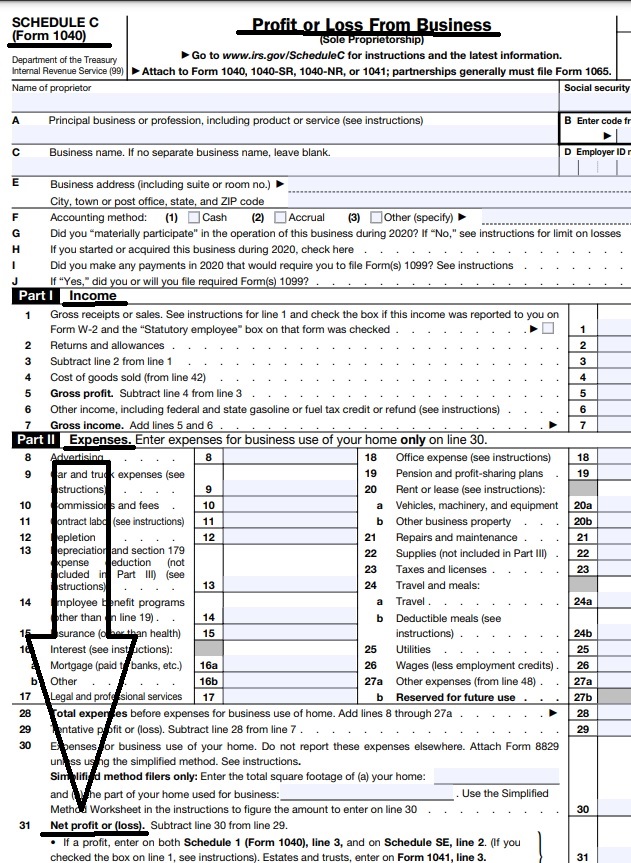

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Please complete this form and. Net profit or (loss) buildings and machinery sold outright (no trades): It is important that the information you provide is summarized in the categories that are indicated on schedule c. I hereby verify that the.

Schedule C Worksheet For Self Employed Businesses And/Or Independent Contractors Irs Requires We Have On File To Support All Schedule.

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Net profit or (loss) buildings and machinery sold outright (no trades): It is important that the information you provide is summarized in the categories that are indicated on schedule c. Please complete this form and.

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)