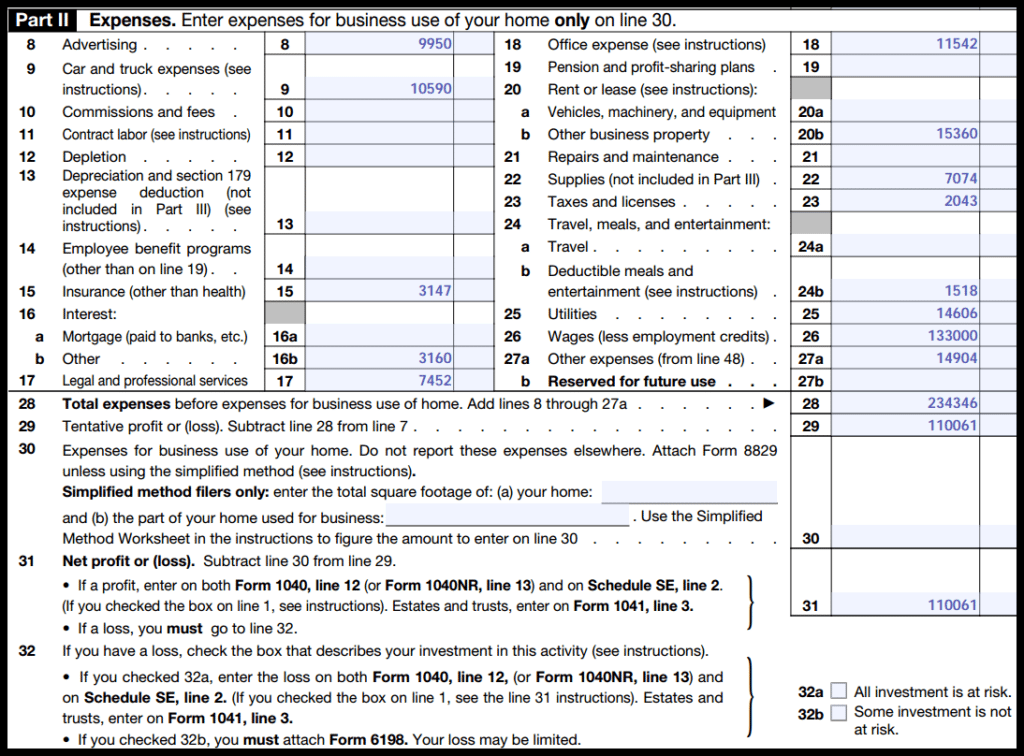

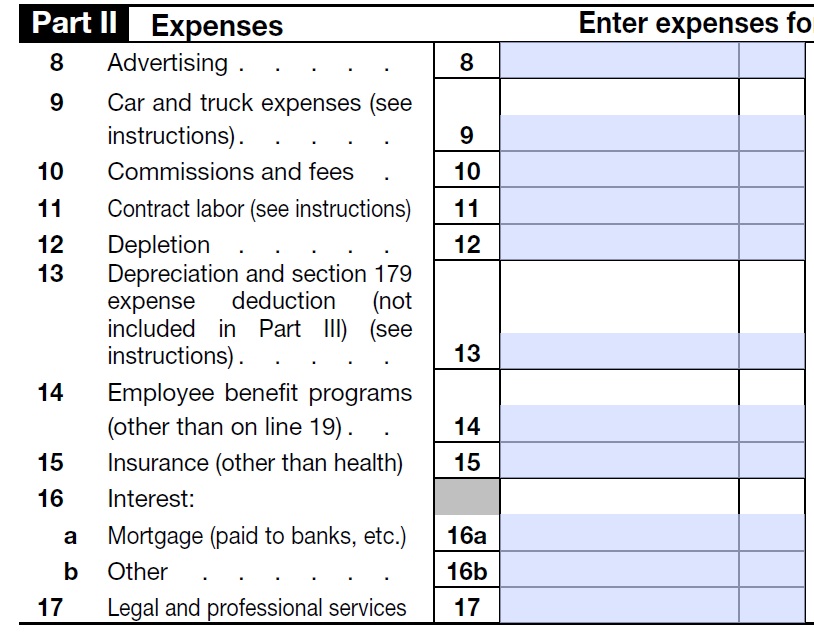

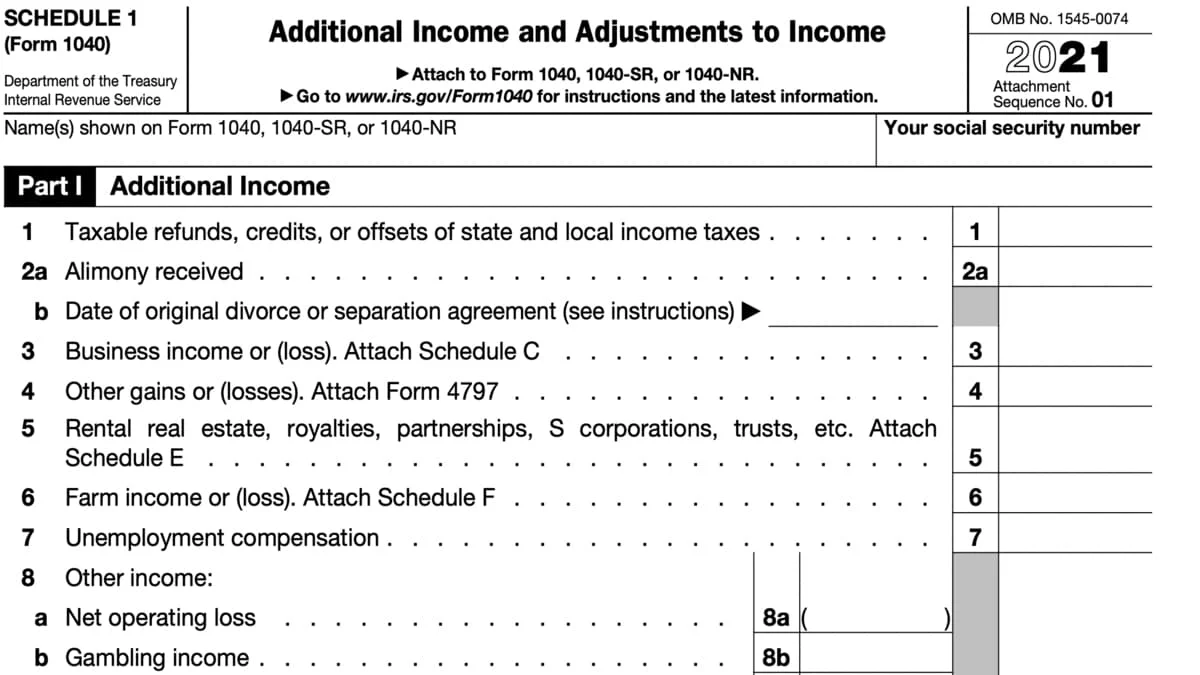

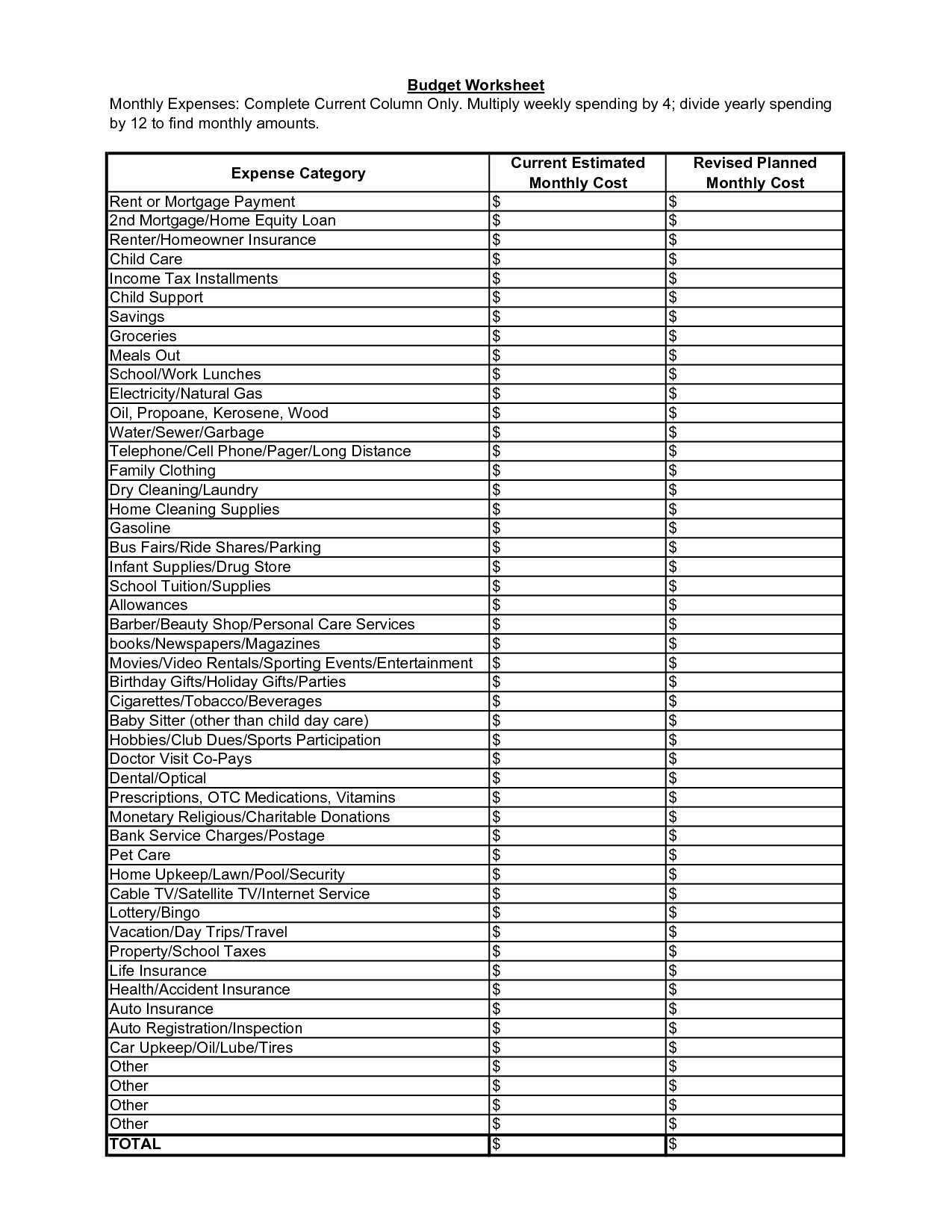

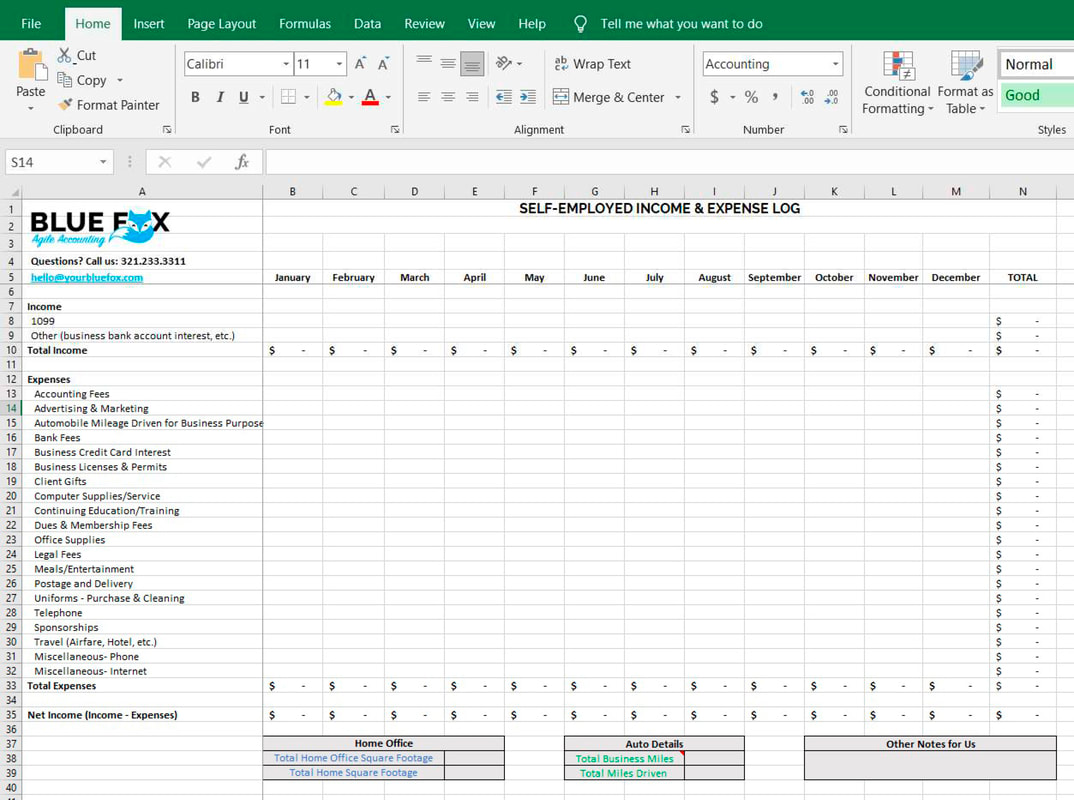

Schedule C Expenses Worksheet 2023 - If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. Advertising $ _________ car/truck $ _________ total miles for year _____ total business miles ____ commissions $ _________. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Expenses for busines use of your home (we will calculate) For real estate transactions, be sure to. Business expenses (ordinary and necessary). If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. If you have your own way of giving us your expense numbers, you can stop here! Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. (b) income and deductions of certain qualified joint.

Advertising $ _________ car/truck $ _________ total miles for year _____ total business miles ____ commissions $ _________. Business expenses (ordinary and necessary). (b) income and deductions of certain qualified joint. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. If you have your own way of giving us your expense numbers, you can stop here! Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. For real estate transactions, be sure to. Expenses for busines use of your home (we will calculate) I hereby verify that the income and expense information set forth on this worksheet is substantiated by written.

If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. Advertising $ _________ car/truck $ _________ total miles for year _____ total business miles ____ commissions $ _________. For real estate transactions, be sure to. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Business expenses (ordinary and necessary). (b) income and deductions of certain qualified joint. Expenses for busines use of your home (we will calculate) I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If you have your own way of giving us your expense numbers, you can stop here!

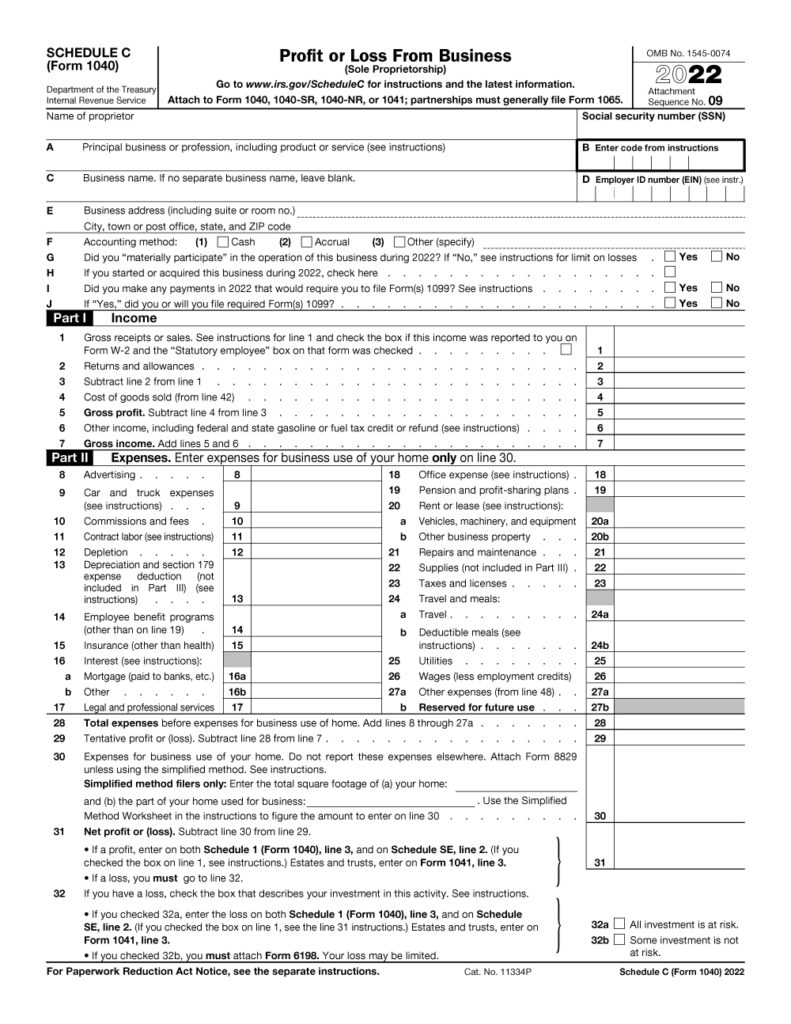

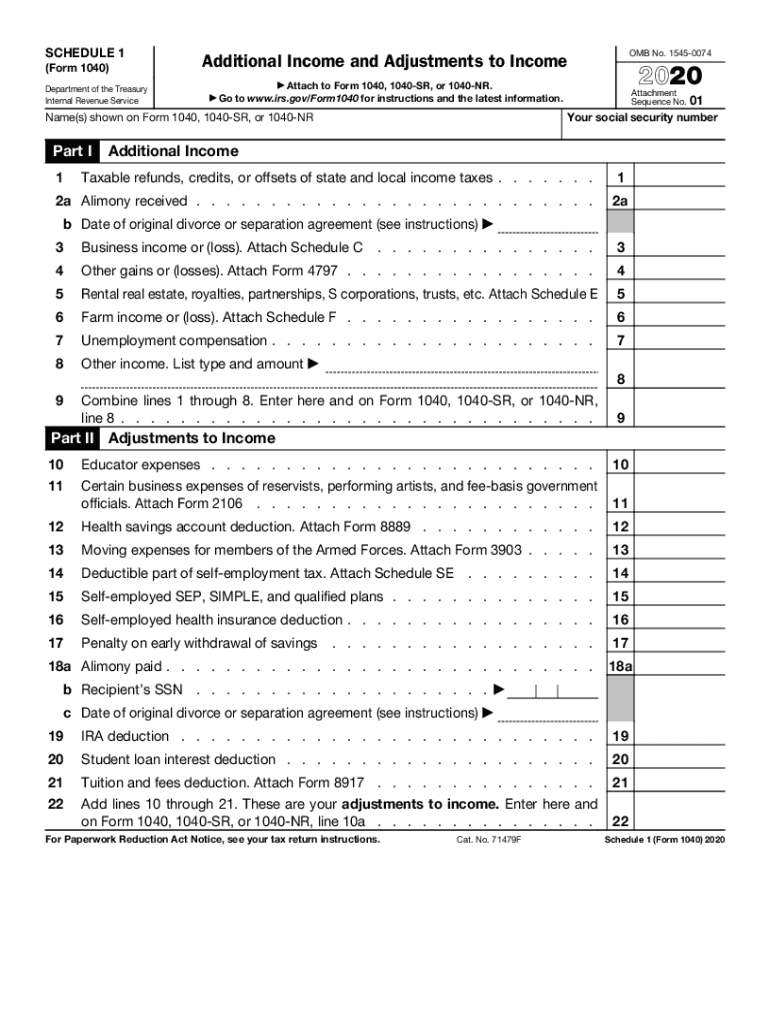

Schedule C Expenses Worksheet 2023

(b) income and deductions of certain qualified joint. If you have your own way of giving us your expense numbers, you can stop here! I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of.

Printable Schedule C 2023

Business expenses (ordinary and necessary). If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. Expenses for busines use of your home (we will calculate) If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. I hereby verify that.

Schedule c expenses worksheet Fill out & sign online DocHub

If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. Expenses for busines use of your home (we will calculate) (b) income and deductions of certain qualified joint. For.

Schedule C Expenses Worksheet 2023

If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. (b) income and deductions of certain qualified joint. Advertising $ _________ car/truck $ _________ total miles for year _____ total.

Schedule C Expenses Worksheet 2023

If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. Advertising $ _________ car/truck $ _________ total miles for year _____ total business miles ____ commissions $ _________. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. Expenses.

Printable Schedule C 2023

If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. For real estate transactions, be sure to. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If you disposed of any business assets in 2023, please enter date sold,.

Schedule C Expenses Worksheet 2023

If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. If you have your own way of giving us your expense numbers, you can stop here! (b) income and deductions of certain qualified joint. Business expenses (ordinary and necessary). If you disposed of any business assets in 2023,.

Schedule C (Form 1040) 2023 Instructions

Expenses for busines use of your home (we will calculate) For real estate transactions, be sure to. Business expenses (ordinary and necessary). I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. (b) income and deductions of certain qualified joint.

Printable Schedule C 2023

Advertising $ _________ car/truck $ _________ total miles for year _____ total business miles ____ commissions $ _________. Expenses for busines use of your home (we will calculate) (b) income and deductions of certain qualified joint. Business expenses (ordinary and necessary). If you have your own way of giving us your expense numbers, you can stop here!

Schedule C Expenses Worksheet 2023

If you have your own way of giving us your expense numbers, you can stop here! Advertising $ _________ car/truck $ _________ total miles for year _____ total business miles ____ commissions $ _________. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Expenses for busines use of your home (we.

Advertising $ _________ Car/Truck $ _________ Total Miles For Year _____ Total Business Miles ____ Commissions $ _________.

For real estate transactions, be sure to. Expenses for busines use of your home (we will calculate) I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If you have your own way of giving us your expense numbers, you can stop here!

(B) Income And Deductions Of Certain Qualified Joint.

Business expenses (ordinary and necessary). Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale.