Uae Vat Return Filing Guide - How to file vat return? You must file for tax return electronically through the fta portal: Filing vat returns on time is essential for ensuring compliance and avoiding penalties. Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations.

How to file vat return? Filing vat returns on time is essential for ensuring compliance and avoiding penalties. Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. You must file for tax return electronically through the fta portal:

How to file vat return? Filing vat returns on time is essential for ensuring compliance and avoiding penalties. Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. You must file for tax return electronically through the fta portal:

How to file VAT Return in UAE how to file VAT return on Emara tax

Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. You must file for tax return electronically through the fta portal: Filing vat returns on time is essential for ensuring compliance and avoiding penalties. How to file vat return?

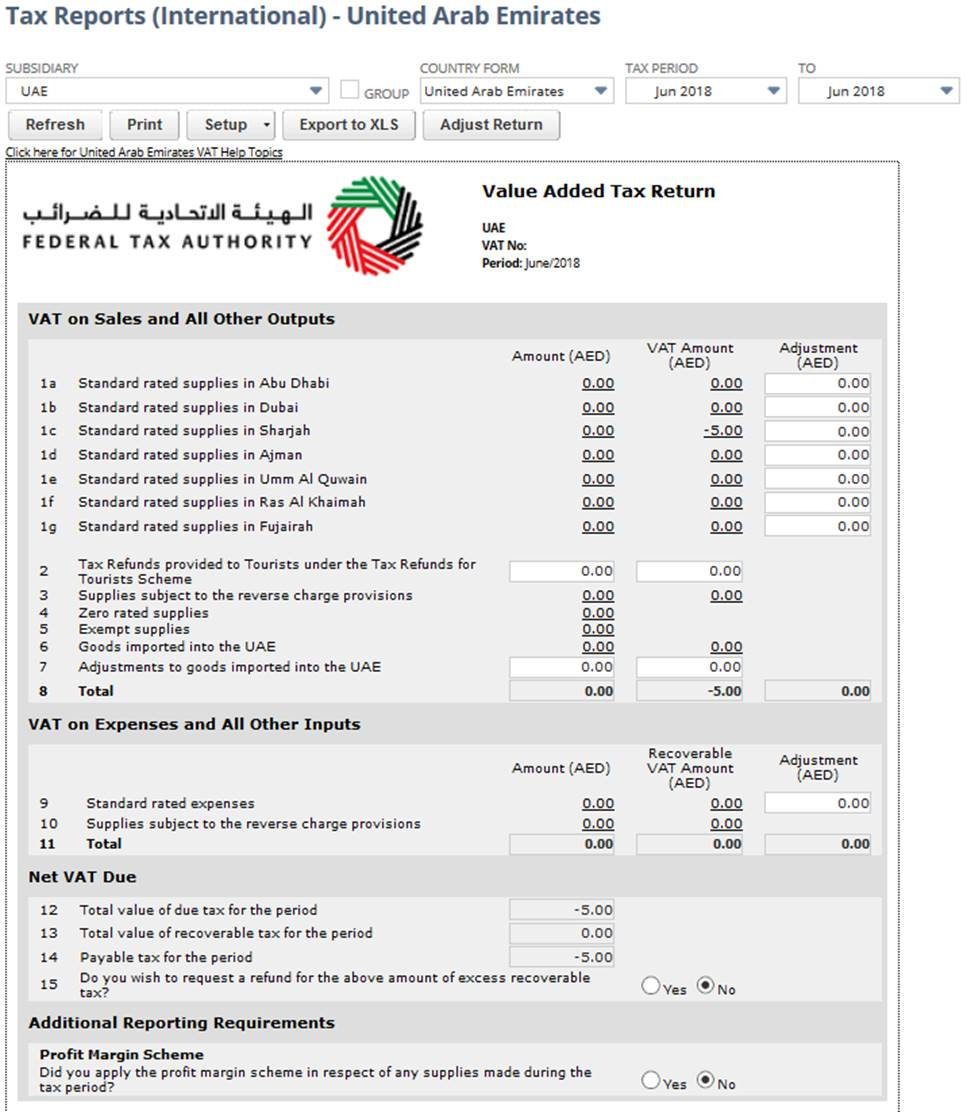

NetSuite Applications Suite United Arab Emirates VAT Report

Filing vat returns on time is essential for ensuring compliance and avoiding penalties. Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. You must file for tax return electronically through the fta portal: How to file vat return?

UAE VAT Return Filing Comprehensive Guide For 2025

Filing vat returns on time is essential for ensuring compliance and avoiding penalties. How to file vat return? Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. You must file for tax return electronically through the fta portal:

A StepByStep Guide On VAT Filing in UAE Tulpar Global Taxation

You must file for tax return electronically through the fta portal: How to file vat return? Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. Filing vat returns on time is essential for ensuring compliance and avoiding penalties.

PPT Vat Return Filing In UAE PowerPoint Presentation, free download

Filing vat returns on time is essential for ensuring compliance and avoiding penalties. You must file for tax return electronically through the fta portal: How to file vat return? Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations.

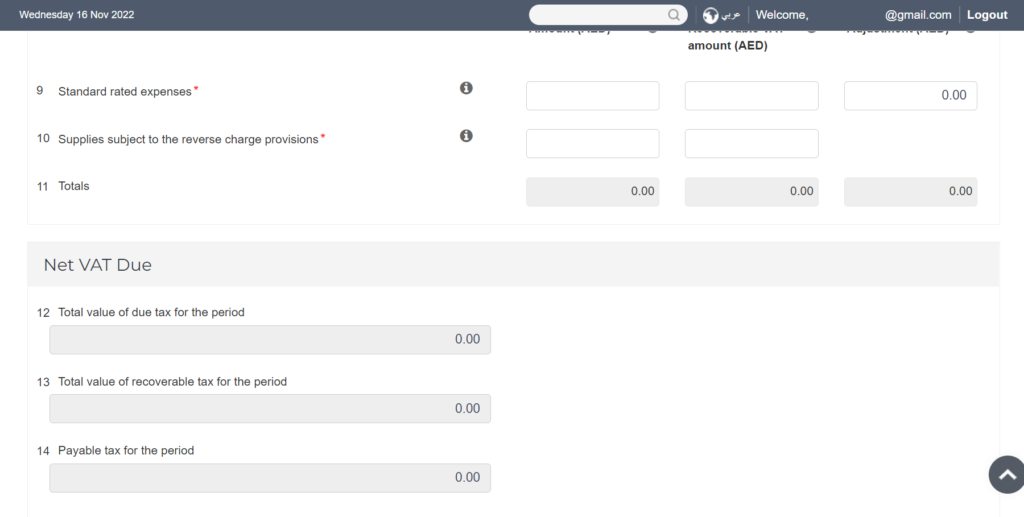

How to File VAT Returns in UAE? A stepbystep VAT Returns User Guide

Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. Filing vat returns on time is essential for ensuring compliance and avoiding penalties. How to file vat return? You must file for tax return electronically through the fta portal:

StepbyStep Guide to Filing VAT Return in UAE

You must file for tax return electronically through the fta portal: Filing vat returns on time is essential for ensuring compliance and avoiding penalties. Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. How to file vat return?

Filing Vat Return in UAE Vat Return UAE How to file VAT Return in

You must file for tax return electronically through the fta portal: Filing vat returns on time is essential for ensuring compliance and avoiding penalties. Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. How to file vat return?

How to file VAT return in UAE On Emara Tax Portal Step wise guide VAT

Filing vat returns on time is essential for ensuring compliance and avoiding penalties. How to file vat return? You must file for tax return electronically through the fta portal: Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations.

Demystifying VAT Return Form 201 A Guide for UAE Businesses

Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. You must file for tax return electronically through the fta portal: Filing vat returns on time is essential for ensuring compliance and avoiding penalties. How to file vat return?

Filing Vat Returns On Time Is Essential For Ensuring Compliance And Avoiding Penalties.

You must file for tax return electronically through the fta portal: Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. How to file vat return?