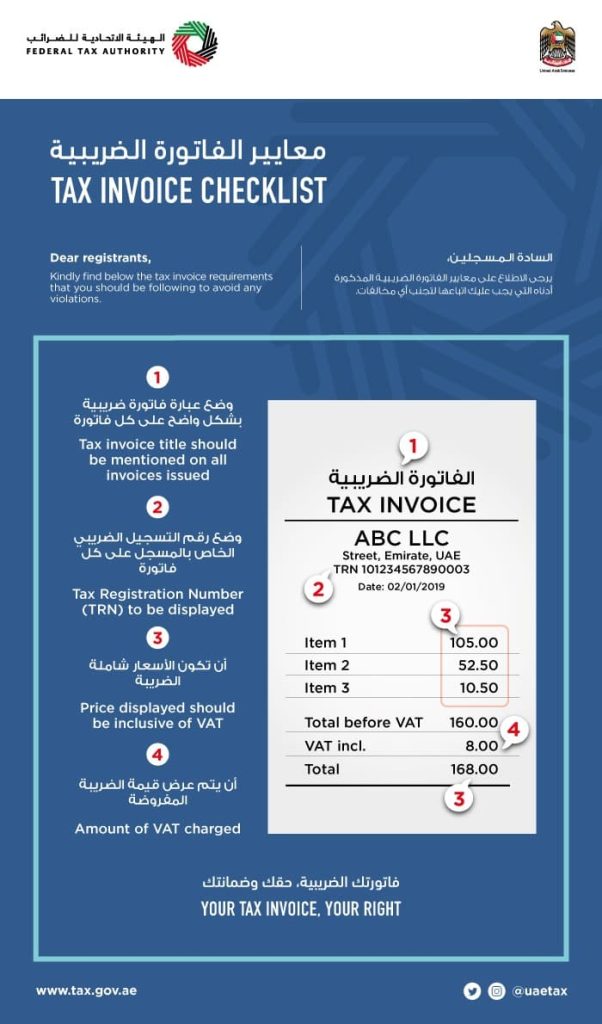

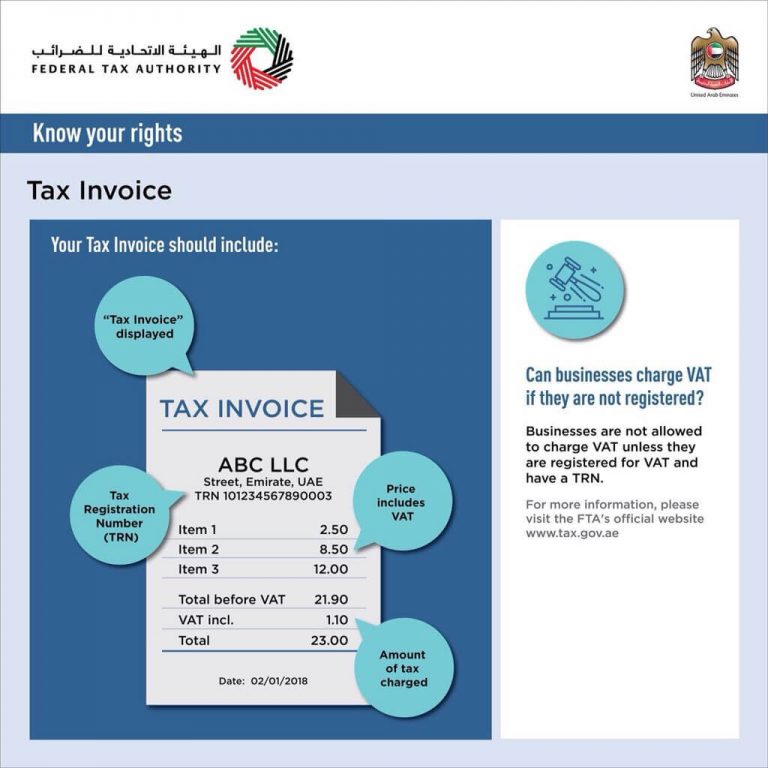

Uae Vat Tax Invoice Requirements - A tax invoice is essential under uae vat law for taxable supplies. It must include trn, invoice date, vat rate, and total amount. You need a valid tax invoice that meets specific standards. Tax invoice (full vat invoice): Required for supplies made to vat. There are two types of vat invoices recognized by the uae fta: Uae vat laws have clear rules about claiming input vat.

Tax invoice (full vat invoice): There are two types of vat invoices recognized by the uae fta: Required for supplies made to vat. Uae vat laws have clear rules about claiming input vat. You need a valid tax invoice that meets specific standards. It must include trn, invoice date, vat rate, and total amount. A tax invoice is essential under uae vat law for taxable supplies.

It must include trn, invoice date, vat rate, and total amount. A tax invoice is essential under uae vat law for taxable supplies. Required for supplies made to vat. Tax invoice (full vat invoice): You need a valid tax invoice that meets specific standards. There are two types of vat invoices recognized by the uae fta: Uae vat laws have clear rules about claiming input vat.

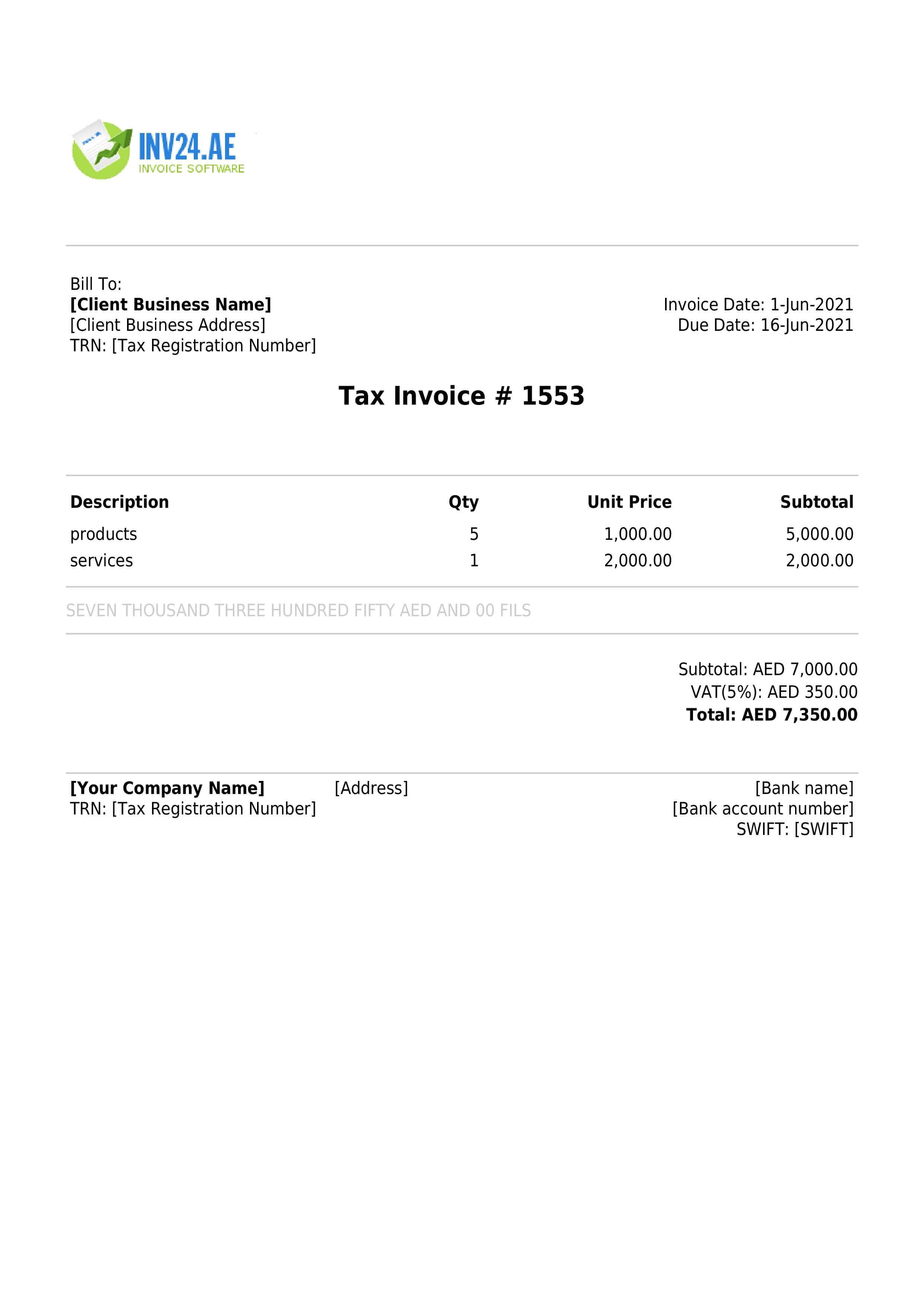

Fully Automated UAE VAT Invoice Template MSOfficeGeek

Tax invoice (full vat invoice): You need a valid tax invoice that meets specific standards. It must include trn, invoice date, vat rate, and total amount. A tax invoice is essential under uae vat law for taxable supplies. Uae vat laws have clear rules about claiming input vat.

VAT Invoice in UAE Definition, Sample and Creation

Uae vat laws have clear rules about claiming input vat. A tax invoice is essential under uae vat law for taxable supplies. It must include trn, invoice date, vat rate, and total amount. There are two types of vat invoices recognized by the uae fta: You need a valid tax invoice that meets specific standards.

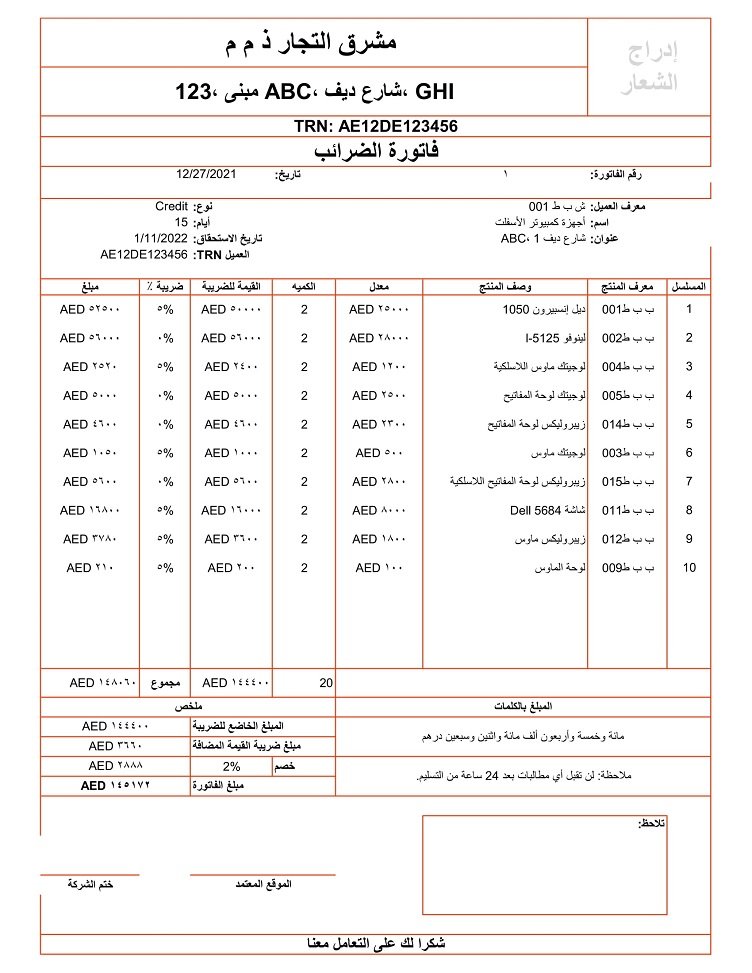

Fully Automated UAE VAT Invoice Template MSOfficeGeek

You need a valid tax invoice that meets specific standards. Uae vat laws have clear rules about claiming input vat. It must include trn, invoice date, vat rate, and total amount. There are two types of vat invoices recognized by the uae fta: Tax invoice (full vat invoice):

PPT Tax Invoice Format UAE PowerPoint Presentation, free download

Required for supplies made to vat. There are two types of vat invoices recognized by the uae fta: A tax invoice is essential under uae vat law for taxable supplies. You need a valid tax invoice that meets specific standards. Tax invoice (full vat invoice):

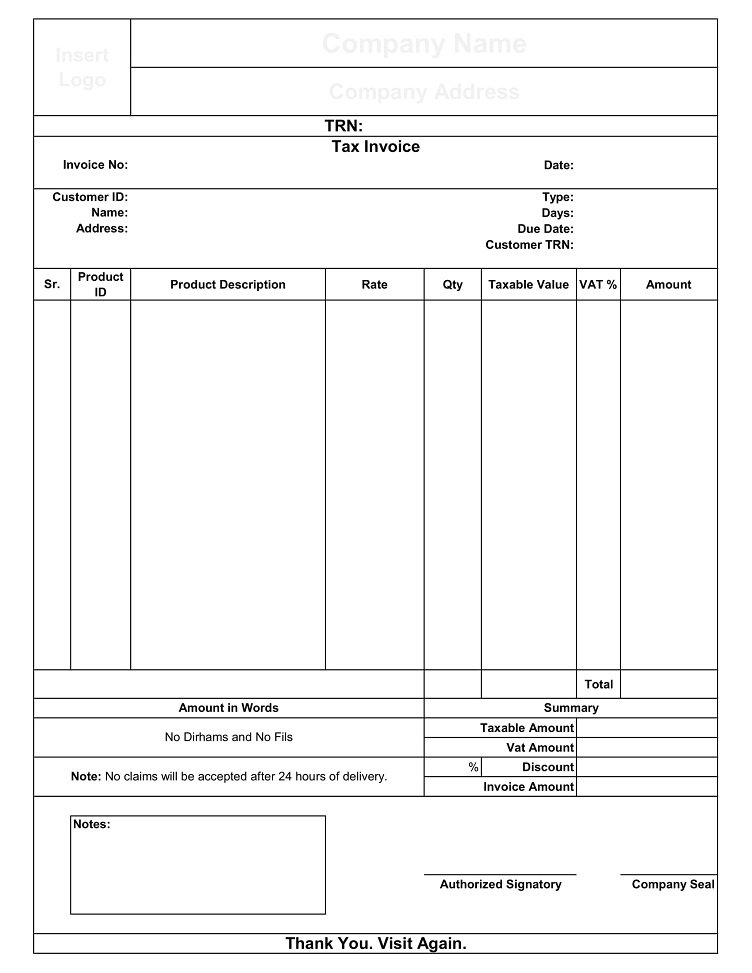

Fully Automated UAE VAT Invoice Template MSOfficeGeek

There are two types of vat invoices recognized by the uae fta: It must include trn, invoice date, vat rate, and total amount. Tax invoice (full vat invoice): You need a valid tax invoice that meets specific standards. Required for supplies made to vat.

Detailed Tax Invoice All About TAX In UAE

It must include trn, invoice date, vat rate, and total amount. Tax invoice (full vat invoice): Uae vat laws have clear rules about claiming input vat. There are two types of vat invoices recognized by the uae fta: A tax invoice is essential under uae vat law for taxable supplies.

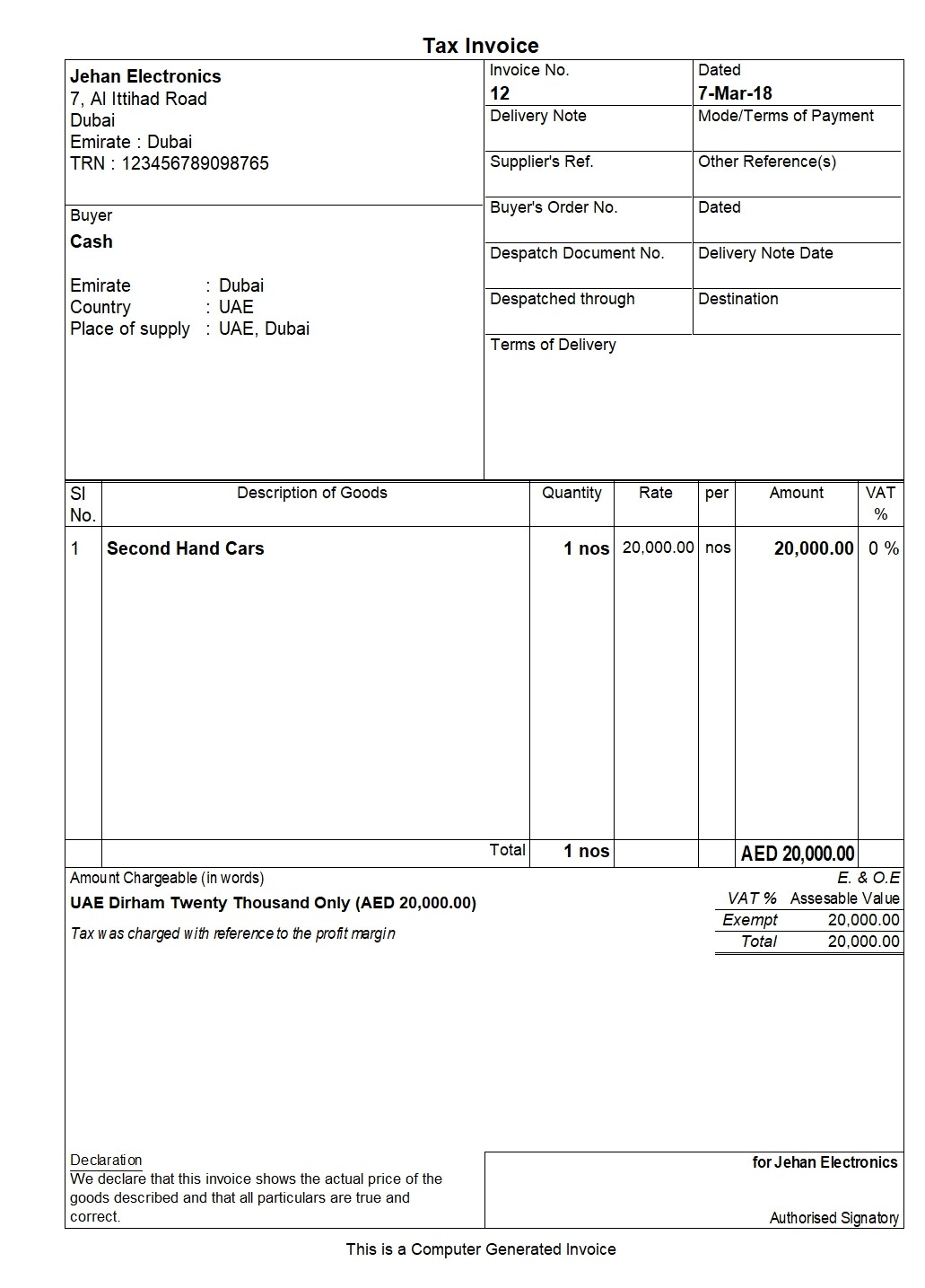

Tax Invoice Under Vat In Uae Tax Invoice Requirements And Format

A tax invoice is essential under uae vat law for taxable supplies. Required for supplies made to vat. Tax invoice (full vat invoice): You need a valid tax invoice that meets specific standards. There are two types of vat invoices recognized by the uae fta:

Difference between a Simplified & Tax Invoice Format in UAE VAT

A tax invoice is essential under uae vat law for taxable supplies. You need a valid tax invoice that meets specific standards. Required for supplies made to vat. Uae vat laws have clear rules about claiming input vat. Tax invoice (full vat invoice):

Tax Invoice Format UAE FTA VAT Invoice UAE Shuraa Tax

There are two types of vat invoices recognized by the uae fta: It must include trn, invoice date, vat rate, and total amount. Tax invoice (full vat invoice): You need a valid tax invoice that meets specific standards. Uae vat laws have clear rules about claiming input vat.

VAT Invoice Format in UAE FTA Tax Invoice Format UAE

Uae vat laws have clear rules about claiming input vat. You need a valid tax invoice that meets specific standards. Tax invoice (full vat invoice): A tax invoice is essential under uae vat law for taxable supplies. There are two types of vat invoices recognized by the uae fta:

A Tax Invoice Is Essential Under Uae Vat Law For Taxable Supplies.

You need a valid tax invoice that meets specific standards. Uae vat laws have clear rules about claiming input vat. Required for supplies made to vat. There are two types of vat invoices recognized by the uae fta:

Tax Invoice (Full Vat Invoice):

It must include trn, invoice date, vat rate, and total amount.